| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Tuesday, 11 July

22:33

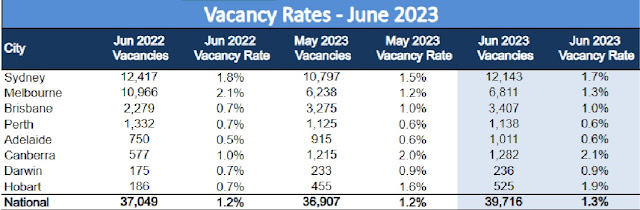

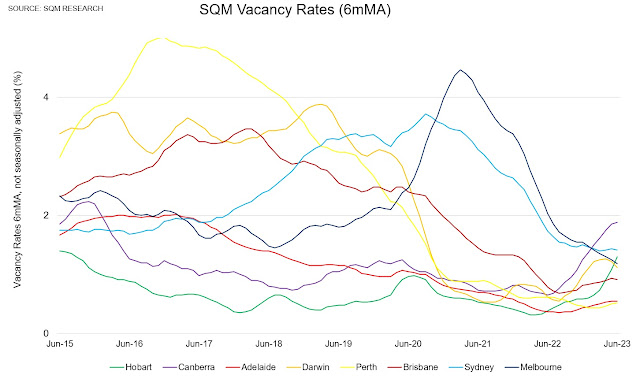

Rental price growth has...peaked! Pete Wargent Daily Blog

15:35

Mr. Musk Goes to Malaysia Pacific Money The Diplomat

Tesla sees some Southeast Asian countries as promising markets for its electric vehicles, and others as possible sites for producing them.

13:00

One Simple Word Can Change Your Thinking Daily Reckoning Australia

Since its dark days of March 2009, Wall Street ably assisted by its central bank benefactor has soared to levels beyond anything we could ever have imagined.

Nasdaq has clocked up a 16-fold gain and the S&P 500 a more modest seven-fold increase. Contrary to what people might think, compound returns of this magnitude ARE NOT normal.

However, the longer something goes on, the more ingrained the belief becomes in its permanency.

This headline from the 4 July 2023 edition of The Wall Street Journal captures the current mood of eternal optimismone-fifth of investors age 85 or older have gone all-in on the marketWOW

|

|

|

Source: The Wall Street Journal |

I recall Buffett saying something like, when others are greedy, you should be scared.

Are this cohort of bullish seniors aware of just how overvalued the US market is?

Instead of being greedy, shouldnt they be scared?

As of 30 June 2023, 16 valuation metrics four of which have data points dating back to 1925/26 are ALL registering readings ofModerately to Extremely Overvalued.

Nothing is cheap out there.

|

|

13:00

The Hardest Landing Daily Reckoning Australia

So, we felt sorry for the owner of a huge mega-yacht that came into the harbour yesterday. Sleek and longwith its own starched-white crew and chefworth maybe US$50$100 million. The rule of thumb is that annual operating expenses come to about 10% of the purchase price.

How proud the owner must have been! His friends and family aboardall impressed by his floating palace

But then, mooring in Taormina bay

the poor owner must have felt like he needed a second job; the yacht was dwarfed by other super-super yachts already in the harbour.

Welcome to the world of the richin Taormina, Sicily.

Rates rocket

We are in Sicily attending a wedding. Despite all the advances in technology AI, cryptos, and luggage with wheels

and all the advances in public policy the Patriot Act, the war in Ukraine, removing statues, and almost 13 years of negative real interest rates

and progress in society itself using they to describe a single person, taking pride in things that used to be unmentionable and unpardonable, and recognising that we are all hopeless racists

people still hitch themselves, one to another, like plow-horses.

And sometimes they want to do it in exotic locationswhich is why we are here.

The wedding went smoothly and elegantly. And then we spent the weekend exploring the countrysideincluding the towns of Castiglione di Sicilia and Troina, where we heard they were giving away houses.

More about thattomorrow.

Today, let us look at the most important thing to happen in the financial markets.

Benzinga reports, 10-Year Treasury Yields Rise Above Inflation for the First Time in Three Years:

In a significant market development, the yield on the 10-year US Treasury note surpassed the rate of inflation for the first time in more than three years. With the current yield at 4.04% and inflation recorded at 4% year-on-year in May 2023, this milestone signals a crucial market shift.

when bond yields surge above inflation, the dynamics change dramatically.

And heres the Reuters report, US two-year Treasury yield surges to 16-year high after employment data:

The two-year US Treasury note yield rose to its highest level since June 2007 on Thursday after news that private payrolls jumped in June, showing that the labour market remains surprisingly strong despite risks of recession from higher interest rates.

Piping hot

What sent interest rates shooting up was news, last week, which told us that the labour market is piping hot. We dont believe it really is; most of the new jobs are actually second jobs taken by people who are desperate to keep up with rising...

05:59

NATO must bring Putin down Crispin Hull

NATO leaders will meet this week in Lithuania, a nation that suffered both the Nazi jackboot and the hammer of Soviet communism. Their main subject, of course, will be Ukraine, which suffered the same fate as Lithuania and now suffers at the hands of the Putin dictatorship.

As those leaders meet, they should reflect upon the words of Robert Jackson delivered during the opening the prosecution at the Nuremberg trial in 1945:

The . . . dream of a peace-and-plenty economy . . . can never be fulfilled if those nations are involved in a war every generation so vast and devastating as to crush the generation that fights and burden the generation that follows. . . .

Wars are started only on the theory and in the confidence that they can be won. Personal punishment, to be suffered only in the event the war is lost, will probably not be a sufficient deterrent to prevent a war where the warmakers feel the chances of defeat to be negligible. But the ultimate step in avoiding periodic wars, which are inevitable in a system of international lawlessness, is to make statesmen responsible to law.

[We must] take joint political action to prevent war if possible, and joint military action to ensure that any nation which starts a war will lose it . . . and that those who start a war will pay for it personally.

This is why NATO must ensure that Russia loses this war and that Vladimir Putin is tried for the crimes of waging an aggressive war; crimes against humanity; murder; and kidnapping.

And so must his associates. Fortunately, like the Nazis, Putin has helped the prosecutors. Remember when he gathered his top echelon and asked each in turn whether they agreed with the invasion of Ukraine. When each nodded assent, they committed a war crime. And each must be bought to account for it.

Of course, the trouble with international law is not lack of law or legal clarity, but the difficulty of enforcement.

The International Criminal Court has issued an arrest warrant against Putin and others. But he visited China with impunity and must have flown over other countries airspace in doing so.

Th...

04:33

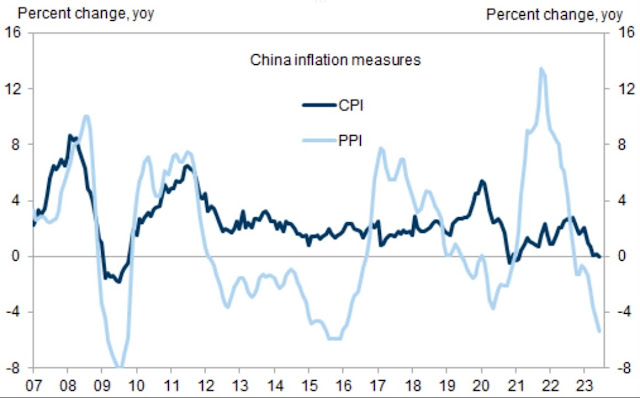

China's reopening proves...deflationary Pete Wargent Daily Blog

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 10 July

23:28

Mongolia Signs Agreement with SpaceX to Utilize Starlink Pacific Money The Diplomat

Mongolia continues its digitalization push by bringing Starlink on board to provide satellite internet service to people in remote locations... in every corner of our vast country.

17:04

Realty Talk: How we got it wrong Pete Wargent Daily Blog

Realty Talk

09:52

Report to the UN shows the threat of ISDS provisions to human rights and the environment AFTINET

10 July, 2023 In response to a call from the UN, legal experts from the Centre for International Environmental Law, International Institute for Sustainable Development and ClientEarth have released a submission outlining the dangers of Investor-State Dispute Settlement (ISDS) on the right to a clean, healthy and sustainable environment.

The report finds that ISDS has a negligible positive impact on foreign investment but is responsible for disproportionate negative impacts on human rights and the environment. Indiscriminate investment protection gives equal protection and compensation to both activities that damage and those that protect the environment, undermining the polluter pays principle.

Moreover, the threat of ISDS claims disincentivises countries from adopting regulation to protect the environment. This, alongside ISDS tribunals focus on investor protections sidelines countries obligations to protect human rights and the environment, weakening implementation of international requirements.

The constraints ISDS has on environmental regulation are particularly clear in countries attempting to transition to low carbon economies, exacerbating inequalities between the Global North and South.

The report outlines four themes in the experiences of countries and public in challenging ISDS claims which undermine access to the right to a clean, healthy and sustainable environment.

- ISDS claims are numerous, often opaque, and largely inaccessible to the public. The use of ISDS enabled investors to bypass domestic courts, which meant the cases could remain, for the most part, private and shut out local communities from participating. Local communities were often denied admission to the case, when their evidence was allowed, environment and human rights considerations were restricted or given inadequate weighting. Moreover, their evidence did not have to be considered by the tribunal, and so for the most part, was not.

- ISDS is a powerful investor lobbying tool to prevent and delay government regulation. The threat of ISDS claims alone are often enough to prevent the government from enacting or maintaining policy measures. Compensation claims for lost future profits can be billions of dollars and cost millions in legal fees to defend. Indeed, both Denmark and New Zealand have...

09:35

US labour market weakening job openings fall and underemployment rises William Mitchell Modern Monetary Theory

Last Friday (July 7, 2023), the US Bureau of Labor Statistics (BLS) released their latest labour market data Employment Situation Summary June 2023 which revealed that the the US labour market has probably reached a turning point but is certainly not contracting at a rate consistent with an imminent recession. There was

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Sunday, 09 July

07:28

F-ck this, I quit: real estate agents leaving the industry in droves?; treechangers to city slickers, & first homebuyer assistance Pete Wargent Daily Blog

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 26 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.50 AUD

Converter

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 22 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.40 AUD

Converter

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 21 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.35 AUD

Converter

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 20 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00003 BTC

0.00010 BTC = 3.95 AUD

Converter

Monday, 19 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00003 BTC

0.00010 BTC = 3.85 AUD

Converter