| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Monday, 10 July

23:28

Mongolia Signs Agreement with SpaceX to Utilize Starlink Pacific Money The Diplomat

Mongolia continues its digitalization push by brining Starlink on board to provide satellite internet service to people in remote locations... in every corner of our vast country.

17:04

Realty Talk: How we got it wrong Pete Wargent Daily Blog

Realty Talk

09:52

Report to the UN shows the threat of ISDS provisions to human rights and the environment AFTINET

10 July, 2023 In response to a call from the UN, legal experts from the Centre for International Environmental Law, International Institute for Sustainable Development and ClientEarth have released a submission outlining the dangers of Investor-State Dispute Settlement (ISDS) on the right to a clean, healthy and sustainable environment.

The report finds that ISDS has a negligible positive impact on foreign investment but is responsible for disproportionate negative impacts on human rights and the environment. Indiscriminate investment protection gives equal protection and compensation to both activities that damage and those that protect the environment, undermining the polluter pays principle.

Moreover, the threat of ISDS claims disincentivises countries from adopting regulation to protect the environment. This, alongside ISDS tribunals focus on investor protections sidelines countries obligations to protect human rights and the environment, weakening implementation of international requirements.

The constraints ISDS has on environmental regulation are particularly clear in countries attempting to transition to low carbon economies, exacerbating inequalities between the Global North and South.

The report outlines four themes in the experiences of countries and public in challenging ISDS claims which undermine access to the right to a clean, healthy and sustainable environment.

- ISDS claims are numerous, often opaque, and largely inaccessible to the public. The use of ISDS enabled investors to bypass domestic courts, which meant the cases could remain, for the most part, private and shut out local communities from participating. Local communities were often denied admission to the case, when their evidence was allowed, environment and human rights considerations were restricted or given inadequate weighting. Moreover, their evidence did not have to be considered by the tribunal, and so for the most part, was not.

- ISDS is a powerful investor lobbying tool to prevent and delay government regulation. The threat of ISDS claims alone are often enough to prevent the government from enacting or maintaining policy measures. Compensation claims for lost future profits can be billions of dollars and cost millions in legal fees to defend. Indeed, both Denmark and New Zealand have...

09:35

US labour market weakening job openings fall and underemployment rises William Mitchell Modern Monetary Theory

Last Friday (July 7, 2023), the US Bureau of Labor Statistics (BLS) released their latest labour market data Employment Situation Summary June 2023 which revealed that the the US labour market has probably reached a turning point but is certainly not contracting at a rate consistent with an imminent recession. There was

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Sunday, 09 July

07:28

F-ck this, I quit: real estate agents leaving the industry in droves?; treechangers to city slickers, & first homebuyer assistance Pete Wargent Daily Blog

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 08 July

22:06

The wheel turns, and Crooked Timber turns 20 John Quiggin

Crooked Timber, the group blog of which Im a member turns 20 today. Heres a post Ive written to mark the occasion.

Not quite 20 years ago, I got an invitation to spend a week as a visiting blogger at an exciting new group blog called Crooked Timber. In the manner of the most catastrophic house guests, I managed to turn that into permanent residence.

Looking back at posts from that time, its startling how active we were; with multiple posts most days. Thats ebbed away to one or two posts per week, but we are still here to celebrate our 20th anniversary, unlike most of the people who were blogging back then.

Its easy enough to see why this was so. Back then, although the term social media wasnt in widespread use, social media was blogs and not much else. There was no Facebook or Twitter and mainstream media maintained an air of snooty disdain.

Once these commercial platforms arrived, and began attracting millions, then billions of users, the writing was on the wall for traditional blogging. Their features made them accessible to lots of people for whom blogging was just too difficult and, at least initially, their reliance on advertising seemed like a small price to pay. Blogs carried on, but as bloggers moved on or passed on, or just got tired, they mostly werent replaced by new entrants.

The deal for users got worse and worse over time, in the process Cory Doctorow calls ensh*ttification. But network effects worked powerfully to keep us all locked into the platforms where our families/friends/interlocutors remained.

Until recently, there was no end in sight to this process. But, as Steins Law has it If something cannot go on forever, it will stop. In the last couple years, weve seen disastrous mis-steps from both Facebook and Twitter, as well as a sharp decline in public opinion of the tech giants and their products.

Thats allowed the emergence of alternatives to advertising-driven networks where algorithms (theyre really just models) determine what you see and what you dont. The most important examples, for me, at any rate, have been Mastodon (non-commercial Twitter alternative) along with the larger Fediverse, and Substack, a platform for subscription-supported newsletters.

We dont yet know what will become of all this. But we built by academics was strictly non-commercial. The introduction of the .com domain produced an explosion of commercial offerings and a speculative mania unsurpassed in scale and silliness, at least until the advent of Bitcoin. A crucial part of this was the attempt by portals like Yahoo and AOL to created walled gardens, where uses would remain while they were online, rather than wandering the wilds of the Internet....

10:30

Welcome to the Global Financial Crisis of 2023 (Part Six) Daily Reckoning Australia

Silvergate Bank Announced its bankruptcy on 8 March 2023

Silicon Valley Bank Taken over by the FDIC on 10 March 2023

Signature Bank Taken over by the FDIC on 12 March 2023

First Republic Bank US$30 billion liquidity rescue by 11 banks on

16 March 2023

Credit Suisse Swiss Government shotgun wedding with UBS on 19 March

2023

Thats five bank failures or rescues in 11 days, including Credit Suisse, one of the largest banks in the world and the second largest in Switzerland.

Combined losses of stockholders and creditors of these institutions exceed US$200 billion. Market losses in the banking sector are much greater.

Walter Wriston, the greatest banker of the 20th century after Pierpont Morgan, personally tutored me on this topic 40 years ago.

In a bank run, you can pull your money out of banks and invest in gold, silver, land, or anything else. But you give the money to the seller, and she puts it back in the bank.

The point is the money always ends up in the bank. The system is a closed circuit.

Of course, it could go to a different bank, but all banks can borrow from each other through the fed funds market and the Eurodollar market. Again, the money always ends up in the bank.

Putting cash in a coffee can (or mattress) is one exception, but if you try to withdraw more than US$10,000, your bank will file a Currency Transaction Report (CTR) with the Financial Crimes Enforcement Network (FinCEN), and youll end up in a file next to Osama bin Laden. And the IRS gets a heads-up.

So, thats not a practical solution.

These failures and rescues were accompanied by extraordinary regulatory actions.

These actions have thrown the US banking system and bank depositors into utter confusion. Are all bank deposits now insured or just the ones Janet Yellen decides are systemically important? Whats the basis for that decision?

The most important question is: Is the crisis over? Has the Fed done enough to reassure depositors that the system is sound? Has the panic subsided?

The answer is no.

The panic is just getting started

We base that answer on the history of the two acute financial crises in recent decades 1998 and 2008.

The 1998 crisis reached the acute stage on 28 September 1998, just before the rescue of LTCM. We were hours away from the sequential shutdown of every stock and bond exchange in the world.

But that crisis began in June 1997 with the devaluation of the Thai baht and massive capital flight from Asia and then Russia. It took 15 months to go from a serious crisis to an existential threat.

Likewise, the 2008 crisis reached the acute stage on 15 September 2008 with the bankruptcy filing of Lehman Brothers.

But that crisis began in the spring of 2007 when HSBC surprised markets with an announcement that mortgage losses h...

10:30

Its Time to Get a Second Opinion on Inflation and Use Some Home Remedies to Escape it Daily Reckoning Australia

What would you do if you knew your doctor has made an incorrect diagnosis before prescribing you some medicine? Would you just sit there and take it?

Because right now, PhD bearing central bankers are completely misunderstanding the source of inflation. And so, their response has been dangerously misguided. But investors dont seem to be acting in response to the threat.

Today, we explore whats really going on, and what you can do about it

As the modern macroeconomists who run our monetary policy see things, inflation is caused by aggregate demand shifts. If people buy more stuff, it raises prices. If theyre buying less, prices fall.

Closely tied to this is employment, which has an impact on the amount people can buy. But its a secondary factor.

A central bankers job is to manage the economy so that demand is growing moderately. If it grows too fast and prices start rising, higher interest rates are used to slow it down. If the economy is struggling and prices dont go up, or even fall, the economy needs stimulus with lower interest rates.

The fact that this doesnt really consider the supply side of things is the first big flaw in the theory. Especially in the wake of a pandemic that disrupted the supply sector of the economy badly.

What weve seen over the past two years is a spike in producer costs. Resources and energy prices surged first, well before consumer prices. Yes, this eventually led to a shift in consumer prices too. But the causation is obvious because of the temporal relationship producer prices moved and then consumer prices followed.

In 2020 and 2021, I tracked this through producer price indices (PPIs) and purchasing manager indices (PMIs). These are also known as factory gate prices, meaning the prices that factories pay for their inputs. They surged rapidly long before consumer prices did, allowing me to predict the consumer price inflation weve seen since.

The misdiagnosis on the part of central bankers confusing the inflationary spike for a demand-based issue rather than a supply issue is the source of what happens next in financial markets.

You see, interest rates are not just important to demand, but to supply too. Raising interest rates doesnt just slow demand. It also raises costs for producers, including those that supply energy and resources, the lack of which caused the PPI spike in the first place.

In other words, central bankers have made producer price spikes worse by adding costs to struggling factories, energy producers, miners, and other producers. Theyve added to the cause of inflation.

Worse still, they have created a demand slowdown where they didnt need to. This is because excess demand was never the source of the inflationary problem. It was one of supply.

Before we unpack the implications for investors, a quick tangent for those of you who are thinking that inflation is everywhere and always a mo...

05:42

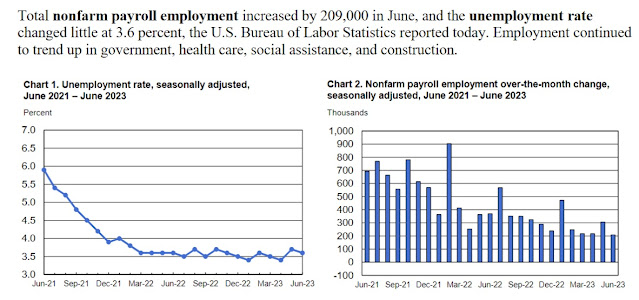

Slowest US jobs gains in 2 years Pete Wargent Daily Blog

Hiring slows

Data out during the week showed a potential surge in employment for the US, but fears that the economy may be significantly overheating again were somewhat allayed when the Bureau of Labor Statistics released its monthly update.

Source: BLS

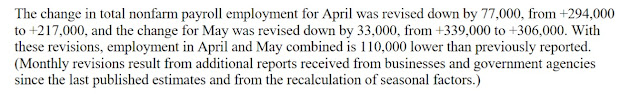

There were also net revisions of -110,000 to the two preceding months, so overall the figures were softer than expected.

Average hourly earnings increased by a stronger than expected 4.4 per cent over the year, and the labor force does remain tight, however, so the Federal Reserve will likely have further work to do to slow the economy and inflation.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 26 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.50 AUD

Converter

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 22 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.40 AUD

Converter

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 21 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.35 AUD

Converter

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 20 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00003 BTC

0.00010 BTC = 3.95 AUD

Converter

Monday, 19 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00003 BTC

0.00010 BTC = 3.85 AUD

Converter