| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Friday, 14 July

00:32

China Exports Slumped 12.4% in June as Global Demand Weakened Pacific Money The Diplomat

The slump since last year is rooted in trade weakness which added to downward pressure on the world's second-largest economy.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 13 July

17:27

US inflation rate down to 3 per cent and falling fast it was transitory, folks William Mitchell Modern Monetary Theory

Yesterdays US inflation data from the Bureau of Labor Statistics (July 12, 2023) Consumer Price Index Summary June 2023 shows a further significant drop in the inflation rate as some of the key supply-side drivers continue to abate. The annual inflation rate is now back to 3 per cent and dropping fast.

14:15

AFTINET Submission to the Inquiry into Australias Human Rights Framework AFTINET

July 13, 2023: The Australian government has launched an inquiry to review the scope and effectiveness of Australias Human Rights Framework and assess whether improvements can be made.

There has been strong civil society support for a reform of Australias Human Rights Framework, particularly for a new Federal Human Rights Act or Charter.

AFTINETs submission shows the profound impact of trade and investment agreements on human rights related to environment, gender, indigenous peoples, labour, health and access to essential services. The submission recommends Australias new human rights mechanism, in whatever form this takes, be capable of evaluating the impact of trade and investment on human rights before they are signed and include enforceable commitments to internationally recognised human rights, labour rights and environmental standards for Australia and other signatory countries.

You can read the full submission here.

01:15

Resi building activity slows -20pc from highs Pete Wargent Daily Blog

Construction pipeline challenges

There's a lot of noise about building in the pipeline, and dwellings 'under construction', but of course many projects have been stalled, mothballed, or delayed, and every day there's a news story about another developer or building firm facing insolvency (three more in the past two days).

Overall, residential building activity, as measured in volume terms, has slowed by -19 per cent from the highs.

Capacity issues in the industry also haven't been helped by ongoing strength in infrastructure projects.

It's nevertheless true that the number of dwellings officially under construction remains high at around 240,000.

The number of detached houses under construction remains above 100,000, which is very high historically.

00:53

US inflation drops below 3pc Pete Wargent Daily Blog

00:48

Dutton wants Australia to join the nuclear renaissance John Quiggin

but this dream has failed before. My latest in The Conversation over the fold

Last week, opposition leader Peter Dutton called for Australia to join what he dubbed the international nuclear energy renaissance.

The same phrase was used 20 years ago to describe plans for a massive expansion of nuclear. New Generation III plants would be safer and more efficient than the Generation II plants built in the 1970s and 1980s. But the supposed renaissance delivered only a trickle of new reactors barely enough to replace retiring plants.

If there was ever going to be a nuclear renaissance, it was then. Back then, solar and wind were still expensive and batteries able to power cars or store power for the grid were in their infancy.

Even if these new smaller, modular reactors can overcome the massive cost blowouts which inevitably dog large plants, its too late for nuclear in Australia. As a new report points out, nuclear would be wildly uncompetitive, costing far more per megawatt hour (MWh) than it does to take energy from sun or wind.

The nuclear renaissance that wasnt

Early in the 21st century, the outlook for nuclear energy seemed more promising than it had in years. As evidence on the dangers of global heating mounted, it became clear that the expansion of coal-fired power in the 1990s especially in Asia had been a mistake.

And despite the prevalence of slogans such as Solar not Nuclear, the cost of solar and wind energy was then too high to make fully renewable systems a reality.

The rise of Generation III and III+ designs promised to eliminate or at least greatly reduce the risk of accidents like those at Three Mile Island and Chernobyl.

The time seemed right for a nuclear renaissance especially in the United States. Between 2007 and 2009, 13 companies applied for construction and operating licenses to build 31 new nucle...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 12 July

17:52

US spending data not demonstrating effectiveness of monetary policy William Mitchell Modern Monetary Theory

I have been looking for signs that the concerted efforts by most central banks (bar the eminently more sensible Bank of Japan) to kill growth and force unemployment up have actually been effective. My prior, of course, is that the interest rates will not significantly reduce growth in the short run, but may if they

17:37

Chip Maker Foxconn Exits Semiconductor Joint Venture With Indian Mining Company Vedanta Pacific Money The Diplomat

The $19.5 billion semiconductor JV was called off due to external issues unrelated to the project, Foxconn said.

10:28

Clive Palmer launches second ISDS case against the Australian government with third case likely AFTINET

12 July, 2023: The Attorney Generals Department has confirmed that Clive Palmers company, Zeph Investment which is registered in Singapore, has lodged a second Investor-State Dispute Settlement (ISDS) claim suing the Australian government for $41.3 billion under the 2012 ASEAN-Australia New Zealand Free Trade Agreement.

ISDS is a mechanism within some trade agreements which enables foreign (but not local) investors to sue governments for millions and even billions of dollars of compensation if they can argue, among other reasons, that a change in domestic law or policy has reduced the value of their investment.

Clive Palmer is claiming to be a Singaporean investor, as Zeph Investment is registered in Singapore, to utilise the ISDS mechanism to lodge his claim. He is alleging that the refusal of coal exploration permits in Queensland, which were refused on environmental grounds, entitles him to ISDS compensation.

Clive Palmers most recent ISDS case is just one of the two new prospective ISDS cases revealed in the May budget papers. The Attorney Generals Department has confirmed that Zeph Investment is expected to lodge a third ISDS case.

These cases follow two previous cases that Clive Palmer has taken against the Australian government. In October 2021, Clive Palmer lost his $27.8 billion High Court (non-ISDS) case against the Western Australian government over a disputed mining lease. He moved assets to Singapore to take this case to an ISDS tribunal and in April 2023 he sued the Australian government for almost $300 billion.

Clive Palmers latest case means he is currently suing the Australian government for $337.3 billion under ISDS, not accounting for a potential third case. Even if Clive Palmer loses these cases, it can be expected to cost the Australian government billions in legal fees. A previous ISDS case between Phillip Morris and the Australian government over plain cigarette packaging cost Australia than $12 billion in legal fees and over 5 years to resolve.

09:24

Post-pandemic Principle #3: Sort out your personal balance sheet Pete Wargent Daily Blog

07:21

This is what's going down with house & land packages Pete Wargent Daily Blog

Australian Property Podcast

Somewhat topical, with builder insolvencies exploding 75 per cent higher over the 2023 financial year, I asked Amy Lunardi about what's happening with house and land packages.

Tune in here (or click on the image below):

You can also watch the video

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 11 July

02:17

Monday assorted links "IndyWatch Feed Economics"

1. Bhutanese leaving for Australia.

2. Uri Geller update, and Uri Geller as hoarder (NYT).

3. AI translates Akkadian tablets. And the latest capabilities of GPT-4.

4. Guam (NYT, a very good piece).

5. Wemby up to 27 points for his second Summer League game.

6. Sri Lankan speculative fiction.

The post Monday assorted links appeared first on Marginal REVOLUTION.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 04 July

13:40

Race Riots and Culture Wars Daily Reckoning Australia

What was it like?

What?

Parisduring the riots.

Were there riots?

Every country has its railroad tracks. And some people are inevitably on the other side of them. In Paris, poor people tend to live in the suburbs. One of them got killed by police last week. Those of us in the centre of town barely noticed.

Nationwide, the French seem to be having their own George Floyd moment.

Heres CNN:

Chaos, destruction and confrontations have led to curfews in some towns around the capital. Bus and tram services faced disruptions with a nationwide shutdown ordered for 9:00pm on Friday to try to stem another night of violence.

Areas within some of Frances major cities have erupted in violence for several successive nights after a teenager named Nahel Merzouk, reportedly of Algerian descent, was fatally shot by police an incident caught on video.

More than 800 people were arrested the night of 29 June, as outrage continued to intensify. Merzouks death appears to have become a flashpoint for anger about racial inequality in France and claims of police discrimination.

Culture warriors

Meanwhile, racism is a big deal in the US too. There is a whole brigade of culture warriors ready to call it outstamp it outand duke it out. They see racism everywhere.

The Daily Beast: White Professor Disgusts Women Historians Conference:

A conference for female historians this weekend was plunged into turmoil when a prominent white academic speaking at the main event said her professional life would have been easier if she were black.

She was immediately called out for her blatantly racist remarks, and refused to apologise, let alone listen, to the reason why her remarks were horrifyingly wrong

And heres another click-baiting headline from something called BuzzLoving:

White men are a danger to society, says a member of San Franciscos reparations committee.

This past weekend, the US press reeled and railed over the Supreme Courts latest decision on universities race-based admissions programs. In brief, the court recognised that you cant discriminate in favour of one group (blacks, for example) without discriminating against another (Asians, for instance).

This anti-racist decision was immediately attacked asyesracism!

Fox News:

...Jemele Hill accuses Asians of carrying the water for white supremacy for backing affirmative action decision.

Harvard pledged to go forth and sin no moreat least not openly. It said, however, that it would continue to take other circumstances, beyond test scores and academic achievements, into account.

13:40

How Do You Hold onto a Bird in the Hand? Daily Reckoning Australia

One of the best pieces of advice I received early in my financial advisory career came from a seasoned investment professional.

His words still ring in my ears

Vern, whenever you hear this five-word preface you cant go wrong buying, thats the moment when everything can go wrong.

Why?

Because once every man and his dog thinks something is a sure bet, cant fail, one-way trip to assured wealth, it means that all risk has been discounted out of the investment equationand thats when an investment contains its most risk.

The only thing thats guaranteed in this business is there are no guarantees.

There are two components to an investmentincome and capital gain.

Neither is assured.

For example, in April 2020, during the COVID meltdown, APRA Chairman, Wayne Byres, penned a letter to the banks, stating:

APRA expects ADIs [Authorised Deposit-taking Institutions] and insurers to limit discretionary capital distributions in the months ahead, to ensure that they instead use buffers and maintain capacity to continue to lend and underwrite insurance

As reported by IG Capital at the time

In response to APRAs letter; Macquarie analysts today said that the big four banks may be forced to either reduce or suspend their next wave of dividends completely.

Looking at a stressed scenario; Macquarie posits that bank losses could run as high as $2527 billion per bank. In this possible world, the banks ability to pay dividends (without raising equity) materially diminishes, it was noted.

Recent history has taught us that other sources of income are not set in stone either.

In 2010, with the RBA cash rate around 5%, who would ever have thought a decade later, money in the bank would earn next-to-nothing?

Who could have anticipated how work-from-home would upset the commercial property applecart?

With higher vacancy levels, per-square-metre rent rates have

come under pressure.

Landlords have suffered a double whammyfalling rental income and

lower property values.

Nothing is ever absolutely guaranteed

Things happen that can change market dynamics.

And what was once placed in the category of you cant go wrong buying, suddenly shifts to how did we get this so wrong?

Of the two types of investment returns, income is perceived as the bird in the hand, while growth is the two in the bush.

So, how do you increase the odds of holding onto that bird in your hand?

With the guidance of someone who has been there and done that.

This is an unashamed plug for my good mate, Greg Canavan

Ive been in this business for 37 years and have seen a lot of investment professionals....

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 03 July

17:17

Australian Vintage [ASX:AVG] Shares Jump 10% as It Undertakes Strategic Review Daily Reckoning Australia

Australian Vintage [ASX:AVG], the company behind popular wine brands Tempus Two, McGuigan, and Nepenthe, has announced the initiation of a strategic review to explore options to unlock shareholder value.

Investors were relieved at the news, with the share price jumping by 10% today, trading at 43 cents per share.

The decision comes in light of the challenging business environment faced by AVG, including inflationary impacts, pressure from consumer trends, and tough market dynamics affecting pricing.

The market has reacted to these challenges, with AVGs shares declining by nearly 40 % over the past year. While the company experienced a surge in demand during the pandemic as consumers shifted to at-home consumption, reaching a 13-year high of 89 cents between March 2020 and June 2021 it remains a far cry from the highs witnessed in the early 2000s.

Source: Trading View

Australian Vintage explores alternatives

Australian Vintage announced today the beginning of a strategic review by corporate advisory firm E&P to explore options to unlock shareholder value in a challenging environment.

The decision to undertake the review comes in the wake of a challenging mid-June trading update for Australian Vintage, which highlighted the impact of the cost-of-living pinch on demand for affordable wines among Australian consumers.

The company responded by cancelling its final dividend and announcing a $9 million cost-cutting plan to mitigate ongoing inflationary pressures and the negative effects of excess wine capacity on margins.

Despite these challenges, AVG has managed to increase its market share across all key geographies, particularly in the rapidly growing Zero and Low-alcohol wine markets.

Craig Garvin, the former Australian CEO of Parmalat dairy business, leads Australian Vintage as its CEO...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 01 July

10:30

Net Zero is the greatest folly since the Childrens Crusade Daily Reckoning Australia

Ive just finished editing seven hours of interviews with net zero experts, including James Cooper of Diggers and Drillers. So, youll have to forgive me for being a bit myopic about my topic.

The good news is that I learned quite a lot about net zeros impact on us, even after writing a book about the topic in the six months before the interviews.

More on the book and the interviews in the coming weeks. Today, lets focus on what I learned from my guests.

The first lesson is that the inherent complexity of the topic makes it easy to reach any conclusion youd like. For example, when comparing the cost of energy from a variety of sources, the conclusion is entirely determined by what is included in the calculation. There is simply no fair way to compare the various energy sources if you ask me.

This is partly because of the second thing I learned. While we currently use fuel to feed our energy demand, the transition to renewables is a transition to solids, for want of a better term. Instead of using up fuels like coal, gas and oil, renewable energy uses up commodities like steel, copper, cobalt, lithium and many more.

This completely mucks up the comparison between fossil fuel energy and renewables. This is because the key cost of running a coal or gas power plant is the fuel input, which is a recurring variable cost. The key cost of renewables is the initial construction and sourcing of materials needed, after which the power is theoretically free.

But how do you compare the cost of building something to the ongoing cost of fuelling something? By having to make so many assumptions that your assumptions end up defining the analysis.

Each different type of energy also has its contingent costs. Renewable energy needs power storage because of intermittency. There simply isnt any form of storage thats viable, scalable and cost-effective for an economy, even if we could find enough resources to build it. So how do you compare a renewables system to a fossil fuel system?

Ironically, countries with high renewables levels currently use a fossil fuel grid as renewable energys backup. Which adds vast costs of having to keep it ready. Thats why places with high levels of renewables have high power costs. They need two grids, one of which is only called on sometimes.

We source a lot of fossil fuels from places with a lot of geopolitical risks. An interruption of supply completely shuts down energy markets, which wouldnt be true of renewables because windmills would keep on turning and solar panels keep on burnin.

There are many other reasons why, but the point is that its nigh impossible to compare the various systems fairly. Their features are just so different. Nuclear really throws a wrench into this because its fuel, uranium, and is a very small part of the cost of a nuclear plant. Meanwhile, ridiculous overregulation and unnecessarily tight safety standards are th...

10:30

Welcome to the Global Financial Crisis of 2023 (Part Five) Daily Reckoning Australia

Frank claimed that the New York bank was hit with a run generated by the nervousness and beyond nervousness from SVB and crypto. The banks digital assets business made it the unfortunate victim of the panic that really goes back to FTX.

|

|

With reference to the Sunday night closure, Barney Frank went on to say, We were fine until the last couple of hours on Friday. Sorry, Barney. If you were only fine until late Friday, that means you were never fine to begin with. Thats risk management 101.

Other corrupt facets of the SVB collapse are breaking daily. Its reported that top insiders of SVB sold millions of dollars of SVB stock over the course of January and February ahead of the recent disclosures. Did they see this meltdown coming?

Insider sellouts

One of those insiders was the CEO of SVB, Gregory Becker. As noted above, Becker sold US$3.5 million of SVB stock on 27 February 2023, just two weeks ahead of the collapse.

Becker was on the board of the Federal Reserve Bank of San Francisco, which was the primary supervisor of SVB. In effect, Becker was regulating his own bank.

His name abruptly disappeared from the Fed website on 10 March, the same day SVB was taken over by the FDIC.

The Fed had just weathered an insider trading scandal in 2022 when it was revealed that several Fed Governors and Presidents of regional Federal Reserve Banks had engaged in insider trading using information gained about the extent of the pandemic in 2020.

Beckers sales of SVB stock ahead of the meltdown look like more of the same insider trading by Fed officials.

It gets worse.

The President of the Federal Reserve Bank of San Francisco is Mary Daly. What was she...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 29 June

14:38

Medibank [ASX:MPL] Faces $250 Million Penalty for Data Breach Daily Reckoning Australia

Shares of Medibank Private [ASX:MPL] are holding strong today, up by 1.71%, as the fallout from last Octobers massive data breach continues. Shares were trading at $3.56 this afternoon as investors remain hopeful that this will be the end of a painful chapter in the companys history.

Medibank has seen its shares claw back to values seen before the data breach eight months ago after shares dropped by 20% when the breach was revealed despite Medibanks best efforts to buffer the bad news and extend the trading pause as the initial shock hit the market.

With current markets fearful, the insurance giant has seen plenty of interest from retail investors looking for safer waters, with shares up by 19.66% in the past 12 months.

Source: TradingView

On Tuesday, the Australian Prudential and Regulation Authority (APRA) announced it has acted against Medibank following a review of the data breach that found their cyber security and oversight inadequate.

APRA has increased Medibanks capital reserve by $250 million as punishment for the breach. The agency said this will remain in place until a review is undertaken by APRA looking at internal governance and risk culture.

The company is also facing three class action lawsuits from customers and shareholders related to the breach as well as a complaint to the Office of the Australian Information Commissioner, which can force Medibank to compensate affected customers.

The hack of Medibank was the fourth largest in Australian history with the criminal organisation stealing 9.7 million customers personal information. These included:

- Date of birth, address, phone numbers, email address, next of kin contact information

- Medicare Numbers for AHM customers

- Health claims for 480,000 customers including sensitive medi...

14:15

Poverty, Drugs and Political Machines Daily Reckoning Australia

An old friend writes from Baltimore:

I was taking a post-prandial stroll the other day, up St Paul, a left on Read, then down again on Charles.

I noticed there was a single car parked inside the 1217 kraal. Two on the lot behind 808.

I noticed the fading For Sale banner on the cast-iron fence in front of the Chas Street property. The dead and deserted lunchtime eateries heading down toward Pratt. Tumbleweeds where Kerrigan Kitikul used to make the best Chicken Pad Thai anywhere, complaining to me about the latter-day yuppies who ordered chicken without the chicken.

No chickens, no yuppies in sight. Just grad students with crap hanging from their pierced nostrils and the bored scribblings of tenth graders permanently etched on their flabby hides.

Looking up to good old George W, I pondered if the time was right to replace him with Horatio Nelson, gazing over the swells at Trafalgarshot-to-sh*t French men owarthe shivered-me timbers of Spanish galleonsa single oar still moving in frantic cones: a lone survivor unaware that the painted Fortuna at the bow was already winking at passing mackerel.

o quae mutatio rerum.

Political machines

Our friend was describing the carcass of our own business! Until 2020, we attracted hundreds of young workers into the cityready to spend their money and enjoy misspending their youth. Now, they see no reason to come into the city at all. Our buildings 10 of them in the heart of the city are mostly empty. They had been grand houses for rich people. Then, after the rich left, they became nice places to work, with desks and computer screens amid the classical trim work.

What has happened to US cities? Democratic mayors, machine politics and wars against poverty and drugs pummelled the cities over decades. Today, we explore the circles of Hell.

Fox Business:

The business districts in a number of Americas major cities like New York and San Francisco are facing an urban doom loop as the workforce shifts away from office work in the wake of the COVID-19 pandemic a trend that has economists raising alarm about the fiscal impacts.

This was not solely the fault of Democratic city governments. While they continued to jab and punch at their own voters, the Trump Administration came at them like Mike Tyson for Evander Holyfields left ear. In March of 2020, Trump proclaimed two weeks to stop the spread a shutdown of much of the US economy. Workers suddenly didnt have to come to the office. They could work, or not, remotely.

Or not

Even then, it was obvious that the COVID virus was a threat to the old and the unfitnot to most people w...

14:07

How to Choose the Right Investment Strategy Daily Reckoning Australia

Its hard to believe that were almost halfway through 2023 already!

So many things have occurred in the last six months that previously wouldve taken decades to unfold.

Several events have revealed therere opposing sides truth.

These include, but are not limited to:

- The state of our global economy and efforts to combat inflation

- The origins of the Wuhan virus and the effectiveness of the control measures implemented in society to quell the outbreak

- The truth behind the concocted accusations of Russian collusion in the 2016 US election

- Investigation into whether the 2020 US election proceeded without undue interference

- How significant mankinds actions are on climate change and whether the proposed policies under the Green Agenda are in fact beneficial

- The real effect of radical policies being implemented by the government to promote equity and inclusion?

Many are only starting to realise that there are often two sides to every story. What you read and who you believe will influence your stance, but different sources can give you completely opposite perspectives.

Trying to discuss these controversial topics with others to help you reconcile in your mind the truth is a delicate and risky task. After all, you dont know which side they stand on each topic and how emotionally invested they are in their viewpoints.

A poorly handled discussion could lead to strained or even broken relationships.

While its good to be on the right side of the discussion, possibly even history, what really is the benefit?

Its funny that Im discussing this. After all, Ive made up my mind on which side I stand on many of these above topics. Ive dared to engage people in discussions over it and even with those whose views are opposite to mine on some occasions.

Sometimes it was respectful and civil. Other times it didnt end well.

When I reflect on these topics and consider what benefit my stances have brought me, I realise something. Having the right viewpoint doesnt equate to a payoff.

What matters is being able to identify actionable steps you can take which can add dollars to your account.

Society doesnt follow whats right. It follows the money.

Thats just the way it is!

Knowing this can help you get ahead of others.

And you dont need to ditch your principles and morals either. I know some do. And neither does it require you to exploit someone for your own gain.

It boils down to your ability to identify the investment opportunities as these events play out.

The Green Agendas nuclear twist

Take, for example, the Green Agenda.

Were all aware of how the world is moving to ditch fossil fuels and...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 27 June

13:40

1929, 1973, 1987 and 2000Why its NOT Different This Time Daily Reckoning Australia

Friendly warningtodays The Daily Reckoning Australia is long on charts and short on text.

These pictures paint more than a thousand words. However, theres only ONE message from todays issue and that ishistory repeats and now is the time to exercise extreme caution.

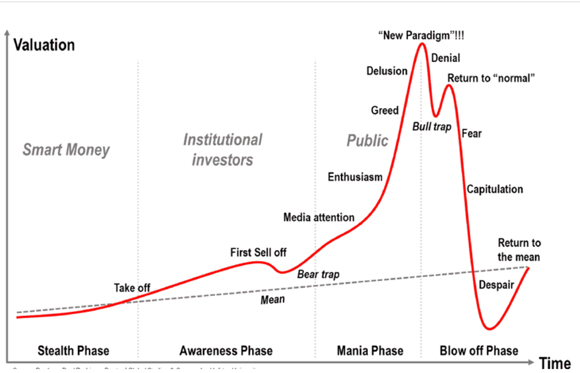

In 2006, while the US Housing Bubble was in full inflating mode, Dr Jean-Paul Rodrigue studied bubbles and manias past to formulate this all-too-repeatable pattern of human behaviour.

|

|

|

Source: Dr. Jean-Paul Rodrigue |

In a detached state of mind, we can rub our chins, nod our heads and think yes, this represents a fair and rational assessment of mans evolving emotional states.

Yet, when were in the middle of it all and markets are playing mind games, its not easy to remain so composed. Patterns get repeated time and time again because, at our core, we are emotional beings. Amidst the racket of fear and greed, voices of reason are invariably drowned out.

There is much whoopin and a hollerin over a new bull market on Wall Street.

Yes, in technical terms, the S&P 500 Index does meet the 20% recovery definition of a new bull market.

But, as I showed in last weeks issue of The Gowdie Advisory, there were no less than four and almost five so-called new bull markets in the Dows near 90% plunge between 1929 and 1932.

...13:28

Ready to Rumble Daily Reckoning Australia

On Saturday, the Wagnerians were on the road to Moscow to confront Putin. By Sunday, a deal had been worked out.

But were talking about something much more amusing, the upcoming battle between Elon Musk and Mark Zuckerberg. The two ultra-billionaires, both serious martial art enthusiasts, were set to square off after Musk supposedly prompted by Zuckerbergs move to compete with Twitter issued a challenge.

It was probably a joke; Musk proposed a cage match.

Zuckerberg shot back send me location.

So, the fight is onmaybe. We hope so. It would be entertaining. And extremely lucrative for everyone involved ringside seats, hotel bookings, broadcast rights, T-shirts and memorabiliait would probably be the single most profitable event in history. Vegas odds-makers are going 3-2 for Musk.

Gentlemanly combat

Settling rivalries with a battle of champions is a venerable way to spare the money and lives that would be lost in a real battle. Its also much more honourable. In the Bible, David and Goliath faced each other single-handedly. So did Achilles and Hector in Homers Iliad.

Typically, the cost of war is borne by those who are least responsible for it taxpayers and draftees. Instead, why not just let the deciders settle it on live TVand make a profit on it? Zelenskyy and Putin, for example, are fighting over who controls the eastern section of Ukraine, traditionally a borderlands area. How about a cage match?

While disputes between nations are often resolved by force, elections are usually a matter of fraud. Hell keep us out of war, promised supporters of Woodrow Wilson. Hell create a Great Society, they pledged for Lyndon Johnson. Hell make America great again, they vouchsafed on Donald Trumps behalf. Once elected, the president then undertakes to reward his campaign donors. Voters are often forgotten or stabbed in the back.

Think about how much expense, corruption, and bombast could be avoided by replacing national elections with cage matches. Hillary versus DonaldDonald versus Joe. Who knows which way these rumbles would gobut they could hardly be worse than the verdict of the voters.

Back on the beat

But lets move onthe Fed has paused. Stocks are still high. Unemployment is still low. And the credit catastrophe, if there is one, is still ahead.

As to the coming catastropheDavid Rosenberg, former head economist at Merrill Lynch, is on the case.

DNyuz:

Hecautioned that investors appear overly optimistic today, just as they were nearly 25 years ago. For example, theyve roughly tripled Nvidias stock price this year, lifting its market capitalisation to north of US$1 trillion. Theyve also more than doubled the stock prices of Tesla, Meta, and other popular tech names too.

...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 24 June

10:30

Welcome to the Global Financial Crisis of 2023 (Part Four) Daily Reckoning Australia

The financial contagion that began with the failure of SVB was never going to be contained to the US. Just as the meltdown virus had jumped from the crypto world to mainstream banking with the failure of Silvergate Bank, the meltdown quickly spread from the US to the international banking system.

The first major overseas victim (but not the last) was Credit Suisse. This bank was founded in 1856 and was one of the two biggest banks in Switzerland (along with UBS).

After long struggles with loan losses, customer frauds, and poor risk management, Credit Suisse received a bridge loan of 50 billion Swiss francs (about US$54 billion) from the Swiss National Bank (SNB) on 16 March 2023 to provide liquidity while other measures were considered.

Finally, on Sunday 19 March, SNB announced a shotgun wedding between UBS and Credit Suisse. UBS acquired Credit Suisse for only 1% of its peak share price. Shareholders of Credit Suisse were largely wiped out but did receive a US$3 billion sliver of proceeds from UBS.

|

|

The financial damage of the Credit Suisse failure ran far deeper than stockholder losses, which, after all, are expected in a failure of this type. A certain kind of bank capital called AT1 was also wiped out. These consisted largely of so-called CoCo bonds, short for contingent convertible.

CoCos do get bailed in

CoCo bonds are high-yield debt that is automatically converted into equity when a bank is in distress. That might be an acceptable outcome when the bank survives. But when the bank fails, the CoCos get wiped out along with the rest of the equity.

CoCo bondholders in Credit Suisse lost US$17 billion, but mark-to-market losses in the larger world of AT1 credits were more than US$275 billion as investors lost confidence in the entire asset c...

10:30

Is Go Woke, Go Broke an Investment Opportunity? Daily Reckoning Australia

Am I getting old and fuddy-duddy? Has becoming a father changed me? Or has the world changed a little since I was a child? And by changed, I mean going mad over the woke phenomenon which has infected all parts of society, from investment to school children.

The latest furore in the woke wars is all about children identifying as animals and inanimate objects while at school. The UK media has discovered a plague of such behaviour, much to nobodys surprise.

Apparently, teachers are required to support such identity dysphoria by reinforcing it. Children are meowing in response to questions from their teachers. And anyone who points out the emperor has no fur is in deep trouble.

Those of you who are worried about woke teachers playing the Pied Piper of Hamelin have got it all wrong. Of course, the children dont really think theyre aardvarks or a Moon, as some of them claim. They are just having fun at our expense. And their ability to do so is probably a sign of intelligence and innovation.

There is no better way to teach critical thinking than forcing the absurd onto someone. Those who wake up and take advantage of this should be celebrated for forcing the issue.

If it takes children to shake us out of our woke delusions, so be it. Thats what happened in The Emperors New Clothes, after all

Another facet of the woke phenomenon Ive noticed is in nursery rhymes themselves. Theyd already been cleaned up since the Brothers Grimm, much to Germans disappointment. Nobody gets eaten alive anymore.

But things are getting a bit ridiculous, with the woke version of Humpty Dumpty featuring Humpty Dumpty getting caught in a baseball mitten by a teddy bear instead of breaking into parts. Jills brother Jack faces an equally melodramatic fate.

I spent a good half an hour looking for original nursery rhymes and traditional nursery rhymes on Spotify, YouTube, and elsewhere at 5:00am one morning. I only got more irritable than I already was over the complete lack of violence. Not that my one-year-old needed more of it after kicking me in the head for the previous five hours.

Edging a little closer to financial markets, we have Anheuser-Busch, which tried to harness the woke movement to sell beer. Who wouldve thought this would backfire?

The old go woke, go broke rule struck, with Bud Light sales crashing badly down 30% at one point. Ironically enough, the response was described as a wake-up call by an Anheuser-Busch executive.

A wake-up call for the woke? What is this? Are we living in the film Inception, with layers of dreams upon dreams to hide objective reality?

In similar strife to Anheuser-Busch, we have Disney, although you might at least expect that company to be woke. And woke they are, with all sorts of cultural appropriation efforts to promote the image of diversity. Which has resulted in poor financial performance and a seri...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 22 June

13:15

Unfree Markets Daily Reckoning Australia

Why should we, the indispensable race, be constrained by nature? Arent we masters of it, not subject to it? After all, if we can set the worlds interest rates and its thermostat, what cant we do?

So many breakthroughs, advances, and improvements; we can scarcely catalogue them, much less keep up with them. Stocks are up. Consumer price inflation is going down. After falling for two years, real wages are stabilising. And the Russians are going to wave a white flag any day now.

And theres Jake Sullivan. After advising Hillary Clinton and Barack Obama, hes now at work for the Biden Team. Every day on the job, he makes the world a better place.

One Giant Step

Let us begin thereand look at a giant step forward for humanity. The Biden Administration has just said goodbye to the free enterprise system that was holding us back for so many years. Now, we will have un-free enterprise; surely that will be an improvement.

Like it or not, you must admit that capitalism is messy. That is its nature. It creates new wealth, but it destroys old wealth, too. You never know exactly which way it is going. But now, Sullivan tells us that he and his fellow elite apparatchiks are going to fix it. They know where they want to go. And theyre going to force US enterprises to take them there. The Wall Street Journal:

laissez-faire is out, industrial policy is in. Markets allocate capital to achieve the highest return to private investors, but as Bidenomics sees it, they dont take account of issues like climate change, fragile supply chains or geopolitical vulnerability. That is why Germany became dangerously dependent on Russian natural gas and China dominates the supply of many critical minerals and pharmaceutical ingredients.

To correct these market failures, Bidenomics aims to direct private capital toward favoured sectors via regulations, subsidies and other interventions. Advocating industrial policywas once considered embarrassing now it should be considered something close to obvious, Sullivan and Jennifer Harris, a colleague in both the Obama and Biden Administrations, wrote in a 2020 essay in Foreign Policy magazine.

Under BidenomicsUS foreign policy champions a range of economic interests, from workers rights to climate policy and tax compliance. Consumers and competition are not primary concerns.

Bidenomics accepts the value of markets but sees market failure all around.

Who decides?

Let us simplify and clarify. People create wealth by providing goods and services to each other. Neither acts of Congress, agency regulations, or presidential proclamations add a penny to our prosperity.

Then, after the people have created wealth, they decide what to do with it. Or someone else decides for them...

13:15

How to Reduce Bill Shock This Winter Daily Reckoning Australia

Unless youre living in northern Australia, youve been experiencing wintery conditions well before June. In fact, May this year was the coldest month for over half a decade.

No doubt most households turned up the heater or put an extra log or three into their fireplaces to keep warm.

Many likely experienced bill shock when their utility bills arrived.

Speaking for myself, our usage hasnt changed much year-on-year, but Im paying 3050% more for my electricity and gas.

As of 1 July, its going to get just that much tougher.

I received an email from my electricity supplier explaining its increasing the price of my usage by another 50%. The daily supply charge will increase by 20%. Similarly, my gas supplier increased the price of my usage in March by around 40%.

Youve probably heard about this already from family and friends.

Its a kick in the guts for many households already struggling to make ends meet. We lived through the ravages of the Wuhan virus outbreak thanks to measures by the government and public health bureaucrats which crippled our economy.

The economic broken window fallacy at work

Many Australians went to the polls last May to oust the Coalition in the hope that the ALP would follow through with their promises to cut electricity bills.

The ALP did have this as a major promise in their election campaign.

However, last October the ALP quietly removed that page from their website.

Do you want to guess why they did that?

To be fair, the ALP did roll out a rebate on electricity bills to provide relief for eligible Australians (pensioners, ex-veterans and family carers). These households and small businesses could see a $175650 relief on their bills.

Dont forget the sharp increase in our utility bills is partly due to the government trying to quickly phase out fossil fuels.

Were seeking to reduce our reliance on the most dependable and cheap fuel source (coal) to transition into something that has yet to pass the test of powering large cities (solar and wind).

Its the good old economic fallacy of a broken window!

Dont forget that a significant proportion of Australians embraced this last May. They elected more than 10 climate change advocates into parliament (the Teal party)!

We made our beds, so now we lie in them.

A not-so-obscure solution w...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 20 June

13:45

Deadwood, Deadends, and Deadheads Daily Reckoning Australia

Whoathat was a close call. It took us nearly 60 years of disappointment, observation, and regret to get it. We didnt want to lose it.

You dont develop cynicism overnight. It takes business deals gone badpolitical promises that we never meant to be keptinnovations and inventions that didnt work outpublic policies that were idiotic when they began, and disastrous when they ended.

In todays world, where would you be without cynicism? Doing five years in the can for visiting the Capitol building without a permit? Joining the Ukrainian army to protect our democracy? Buying Nvidia and trusting that the Fed really does know what it is doing?

We cant even write those words without chuckling to ourselves. It was only two years ago that the Fed forecast inflation for 2023 at 0.1% now they say it will be 5.6%. They were only off by 5,500%!

Stronger, richer, freer?

Last week, US Government debt passed US$32 trillion. And it is growing fast up by US$10 trillion over the last four yearsand now increasing at US$2.1 trillion per year.

And what do you think? Did a single penny of that debt make the US stronger, richer, and freer? How young do you have to be to believe it?

As the debt rises, so do interest rates. Year over year, the Feds interest payments are up nearly 50%. Next year, more tax money will be needed to support the debt than to support the Pentagon.

The private sector is also paying higher interest rates. Companies that took on billions of debt at 3% interest now have to refinance at 7%. And they cant print money.

From Wolf Richter:

companies that only made it this far thanks to Easy Money are now getting hung out to dry.

Bankruptcy filings will whittle down the corporate debt overhang. Many companies will emerge from bankruptcy with less debt, and theyll be nimbler and more able to thrive. Others will be sold off in bits and pieces, making room for appropriately managed companies not encumbered by these issues.

There is a cleansing aspect to this part of the credit cycle that needs to be allowed to do its job to get rid of the excesses and the deadwood at the expense of investors. This cleansing process that has now just started is long overdue.

Mass VC extinction event

And heres Garrett Baldwin at Postcards from the Florida Republic:

Venture Capital has imploded over the last 18 months. Last week, the Wall Street Journal released a distressing analysis. Theyve found many startups are now unable to secure the funding they need. To say VC has been suffering is an understatement. Tom Loverro, a general partner at VC shop IVP, has said The Mass Extinction Event for startups is underway. Venture capital losses ov...

13:45

A Rich Life is Measured by More Than Money Daily Reckoning Australia

Its 3:42am and todays Daily Reckoning Australia finds me in a reflective mood.

My elderly fathers health is failing.

One fall too many has forced him to surrender his highly prized independence.

We knew this day of reckoning was comingbut its still sad to watch.

A tour of the assisted care facilities provided me with a stark reminder of what constitutes a rich life.

When a financial publication usually mentions the term rich, it tends to be associated with money or a vein of ore.

Not this time.

Dont get me wrong, money is important especially when it comes to paying the not-so-insignificant Refundable Accommodation Deposit (RAD). However, when the final tally on your life is done, true net worth is measured by other factors.

Money cant buy love

In 1964, the year when the last of my parents five children was born, The Beatles hit single Cant Buy Me Love was released.

In Paul McCartneys own words, his motivation for the song was

Cant Buy Me Love is my attempt to write a bluesy mode. The idea behind it was that all these material possessions are all very well but they wont buy me what I really want.

Growing up in a working-class family, material possessions were few and far between. Money was needed for the basicsshelter, transportation, food, clothing, and education. Precious little was left for material indulgences.

Society has changed quite a bit since then.

Credit-funded consumerism has literally consumed the developed and a good chunk of the developing world.

The quip, we buy things we dont need, with money we dont have, to impress people we dont like originally referred to Hollywood. These days, it extends well beyond the zip code of Beverly Hills.

And this increasing obsession with look at me on social media suggests the penny has not yet dropped on true love extending beyond self.

Of the limited number of possessions Dad can take with him, the most prized are his photos of family and friends. These are his permanent reminders of a rich lifeone that money alone cannot buy.

When it all gets distilled down, material goods become immaterial and its not how much you love yourself, but how much you are loved by others.

In the final tally, love and respect are what matters most.

Money cant buy happiness

Long before The Beatles were singing Tell me that you want the kind of things that money just cant buy, Roman philosopher Seneca (4 BC to 65 AD) wrote a letter to his mother.

The titleOf Consolation: To Helvia

Heres an extract

Consider in the first place how many more poor people there are than rich, and yet you will not find that they are sadder or...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 17 June

10:30

How the Net Zero Debacle Could Make Australia the Wealthiest Country on Earth, Twice Daily Reckoning Australia

It may well be the most ridiculous idea since the Childrens Crusade. But the net zero campaign still anticipates creating the biggest economic boom in Australia since the gold rush. Both the attempt to reach net zero and its inevitable failure promise to make select groups of Australian investors very rich.

Indeed, we could not have designed a country better suited to profit from the net zero boom and its subsequent doom. We have the natural resources needed for both the bubble and its bust, the industry needed to get at them, the political stability to make the most of it, and the experience of recent history to guide us.

It all reminds me of the Chinese mining boom of 200312 when Australia provided the resources needed to urbanise and modernise China. That era was so good for Australians that our dollar ended up well above parity with the US dollar. And it wasnt just because I migrated here in 2003 either

What Im suggesting is that net zero offers a repeat of this experience but on a much larger scale. This time, the entire world is trying to transition into a different sort of economy.

Also, instead of a bust following the bursting of the 2012 commodities bubble, Australia will discover that it has an abundance of the resources needed in the subsequent boom too.

Imagine being invested in the tech bubble and the housing bubble. Or the FAANG stocks and meme stocks. Thats whats in store for Australia a double whammy.

Let me explain why my usual doom-mongering is taking part in the Sunshine Coast Councils random public holiday today

The first part is quite simple. The net zero campaign requires eliminating or offsetting our carbon emissions. We planwell, we intend to do this in a variety of ways. This includes building renewable energy to replace fossil fuels, electrification of everything that uses fossil fuels, carbon capture and storage, power storage, and much more.

Unfortunately, all of this requires a lot of resources. An impossible amount according to those who bothered to do the maths. (Which didnt include the governments who committed us to the task.)

Conveniently, Australia is home to a lot of the resources that we need impossible amounts of. Top of the list is copper, the metal of electrification, but its a very long list.

Heres how The International Energy Agency, which may have to be renamed The International Energy and Mining Agency, summed it up, with my emphasis added:

[A] concerted effort to reach the goals of the Paris Agreement (climate stabilisation at well below 2 degrees global temperature rise, as in the [IEA Sustainable Development Scenario] SDS) would mean a quadrupling of mineral requirements for clean energy technologies by 2040. An even faster transition, to hit net zero globally by 2050, would require six times more mineral inputs in 2040 than today.

Whi...

10:30

Welcome to the Global Financial Crisis of 2023 (Part Three) Daily Reckoning Australia

The explanation for this bail-in/bailout distinction takes us back in the time machine to the period from 200814.

SVB is more than a wipeout for stockholders. SVB is the first example of a financial regulatory rule put in place by the G20 in November 2014 in the aftermath of the 2008 crisis. There was a popular outcry against using taxpayer money in 2008 to bail out bank CEOs who were making millions, and whose banks are still around. In response, the G20 agreed that in future financial crises, there would be no more bailouts with taxpayer money. The new approach was to be a bail-in.

This means that in the case of a failed bank, equity would be wiped out first, and then depositor funds would be converted to contingent claims if they were above the insured amount. Bank deposit insurance is US$250,000 per deposit in the US and 100,000 per account in the EU.

More than 95% of the deposits in SVB exceeded the insured amount. This means those deposits were gone, according to the FDICs press release on 10 March 2023. Depositors were to get a receivership certificate from the FDIC, which may or not have been worth anything depending on what the FDIC might collect from asset sales.

It could take months to ascertain the size of the SVB losses and a year or longer to sell assets. Depositors might ultimately get 90 cents on the dollar or 10 cents on the dollar. No one would know until the FDIC computed the size of the hole in the SVB balance sheet. The losses would get worse as the fire sale proceeded and asset values dropped further.

Contagion and systemic risk

The systemic problem is that those lost SVB deposits represent venture capital investments and working capital balances for thousands of tech startups and early-stage tech companies. They would have no cash to spare. This means they would not be able to make payroll, pay the rent, pay vendors, or conduct business. Those tech firms would likely fail, tens of thousands would lose jobs, and the ripple effects would spread from there.

The issue of contagion from SVB is interesting and not well understood. Everyone is worried about other banks failing. Thats a real possibility and is likely to happen. But thats far from the only kind of contagion.

Silicon Valley companies and tech firms around the world held in portfolio by SVB would see their stock prices decline as the FDIC conducted a fire sale of assets to pay creditors. Buyers would lower their bids knowing the FDIC was desperate to raise cash.

Theres an unhealthy tension between how quickly you dump assets and how much you can get for them. Generally, a slower approach gets higher prices, but that slow approach may strangle the startups. Top Venture Capitalist (VC) firms warned startups that if their money was lost in SVB, they would not be getting new funding from the VCs. So they would fail.

...Friday, 16 June

16:06

Whats Not Priced In #4: Extreme Greed, Aussie Mortgage Cliff, Neglected REITs Daily Reckoning Australia

Dear reader,

In 1996, legendary investor Philip A Fisher wrote in his classic book Common Stocks and Uncommon Profits and Other Writings that independence of thought was vital for outperformance:

This matter of training oneself not to go with the crowd but to be able to zig when the crowd zags, in my opinion, is one of the most important fundamentals of investment success.

Huge profits are frequently available to those who zig when most of the financial community is zagging, providing they have strong indications that they are right in their zigging.

Zigging when others are zagging is a crucial market skill.

Its also the principle driving Fat Tail Investment Researchs latest podcast featuring Greg Canavan Whats Not Priced In.

Its a podcast that reacts to every news story with, Yeah, yeahbut tell me whats not reflected in the consensus view.

The pod is already a running gag in the office.

Any time someone shares a news item, someone else will quip, Thats already in the price! Whats not priced in?

In its own little way, the podcast is having a cultural impact.

Narrow and greedy tech rally

Sometimes, to figure out whats not priced in, you must identify what already is.

With that in mind, this week Greg and I unpacked the latest Fed decision and surprising moves in the US stock market.

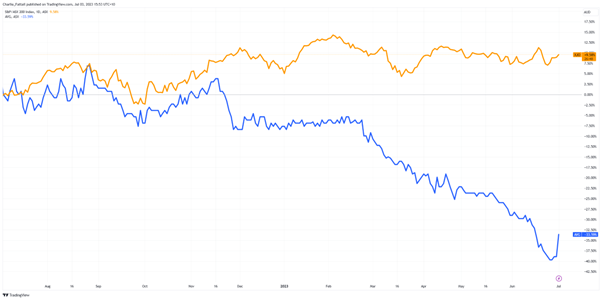

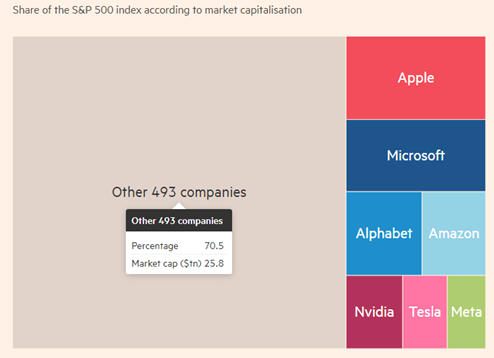

The benchmark S&P 500 is in a technical bull market, up by more than 20% since its October 2022 lows.

But thats largely due to a handful of mega-cap stocks like Apple Inc [NASDAQ:AAPL], Nvidia Corp [NASDAQ:NVDA], and Microsoft Corp [NASDAQ:MSFT].

Source: Financial Times

Apple alone is worth more than the entire Russell 2000 Index of smaller US companies!

This is all highly unusual.

I asked Greg if he was surprised by the moves of the US tech stocks, and he admitted its peculiar.

Especially when you consider the latest readings from CNNs Fear and Greed Index the gauge is screaming extreme greed, hitting its greediest level in a year.

Greg then...

15:43

AGL [ASX:AGL] Doubles Earnings and Profit Guidance Daily Reckoning Australia

On Friday morning, power company AGL Energy [ASX:AGL] had its stocks soaring by more than 12% after the group posted a profit guidance upgrade as part of its investor presentation.

By lunchtime, AGLs share price had surged by over 12% to $10.84 a share, taking its monthly metrics up by 23% a 34% gain so far in 2023.

In its sector, the power stock has a 16% advantage and is also 23% higher than the broader markets 12-month average:

Source: TradingView

AGL refines and upgrades profit and earnings guidance

Today, AGL was making headlines with its latest on earnings guidance and business conditions while presenting for its Investor Day talking FY23 and FY24 earnings, profits and dividends.

The power touched on its overall business strategy, growth plan, operations and financial performance. However, perhaps the biggest highlight was the groups decision to upgrade and refine its earnings and profits guidance.

AGL has enhanced earnings guidance for FY2023 to a range of $1.3 billion1.375 billion, from $1.25 billion1.375 billion, as previously provided.

The groups underlying profit guidance was also revised to between $255 million285 million, from a previous forecast of $200 million280 million.

AGL stated that these were changes that reflected on improving conditions which are expected to continue into the second half of the year.

For fiscal 2024, AGL predicts between $1.875 billion2.175 billion in underlying earnings and between $580 million780 million in underlying profit after tax. This sudden upgrade is due to higher electricity prices and an increase in plant production.

AGL has now decided that it will be paying a dividend payout ratio of 5075% of underlying profit after tax to be completely franked instead of a payout ratio of 75%, as was its previous policy....