| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Sunday, 11 June

18:12

2-Sense: Wages, lending, & construction crunch Pete Wargent Daily Blog

17:31

396. Landing at Sydney Airport (video) Pannell Discussions

I took this video of the approach to landing in Sydney in May, and it worked out so beautifully that I thought it was worth sharing.

It was late afternoon, and the soft evening light is fantastic. As the video starts, Sydney Harbour Bridge and Sydney Opera House are in the centre of the frame, with the central city on the right. The view is absolutely stunning, including dramatic clouds and some rain in the distance, though the foreground is sunny. We pass islands and yachts on the harbour, a bridge, houses, roads, a very pointy church spire, train lines, commercial buildings, shipping containers, and a canal before reaching the airport. Unfortunately, the video doesnt catch the message painted on almost the last roof before we reached the airport fence, saying Welcome to Perth!

From about the 1:50 mark, you can see the shadow of the plane sliding across buildings in the distance, and it gives you a great impression of how low in the sky the sun was. The shadow gets bigger and bigger and closer and closer until it meets the plane at touchdown.

&&&&&&

Im strongly reminded of Paul Kellys great song, Sydney from a 727.

Now the red roofs are catching the first rays of

the morning sun

My eyes are full of sand from my midnight run

And the captain says...

06:19

Breaking out of comfort zones Pete Wargent Daily Blog

Check it out here (or click on the image below):

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 10 June

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00003 BTC

0.00010 BTC = 3.85 AUD

Converter

10:30

Welcome to the Global Financial Crisis of 2023 (Part Two) Daily Reckoning Australia

Lets recap a simple timeline of events. That will give us a baseline for considering the more technical aspects of the bailout, and some of the corruption going on behind the scenes. Put on your crash helmets. Youre going to need them.

The chronology of a collapse

The SVB collapse is, in some ways, the bitter fruit of eight years of zero interest rates (20082015) under Ben Bernanke and Janet Yellen. That zero-interest rate policy and the accompanying US$4 trillion of quantitative easing (QE1, QE2, QE3, and so on) created an age in which investors were forced to channel savings into riskier assets such as stocks, real estate, and emerging markets in a chase for yield.

Those asset bubbles were amplified with borrowed money in the form of carry trades and derivatives. No one cared about the potential for higher interest rates and monetary tightening. That seemed to be off the table. Investors were driven by TINA (There is No Alternative) and FOMO (Fear of Missing Out).

A narrower timeline would begin in November 2021. Two critical events happened that month. The first is that Fed Chair Jay Powell threw in the towel on his view that inflation was transitory. Powell made it clear that inflation was a real threat, and that the Fed would soon be taking steps to stop it. A few months later, in March 2022, Powell began a series of nine interest rate hikes, which continue today.

The second event, perhaps not coincidentally coinciding with the first, is that Bitcoin [BTC] began to crash from an all-time high of US$68,990 to US$15,480 in November 2022 a 78% crash in one year that started what crypto cultists call the Crypto Winter. This crypto crash has direct connections to the SVB collapse, which we explain below.

While December 2008 and November 2021 are both good starting points for our story, the day-by-day chronology specific to SVB really begins on 27 February 2023, when the SVB CEO dumped US$3.5 million of SVB stock. On the same day, the banks CFO dumped US$575,000 in the banks stock. Both executives claim these sales were pursuant to pre-announced programs allowed by the SEC.

Still, SVBs unrealised losses (unknown to the public) date back years, so the programmed selling may itself have been a cover for what they both knew was coming. The SVB stock price at the time of those sales was about US$290 per share. Today it is worthless. The insiders got out in time.

Remember the debt ratings agencies?

On 1 March 2023, rating agency Moodys called SVB management to tell them that Moodys was considering downgrading the credit rating of the bank. This set off alarm bells inside SVB. Management knew that a credit downgrade might start a flood of deposit withdrawals and a crash in the stock price. The CEO, Greg Becker, immediately called Goldman Sachs to work out...

10:30

How Australia learned to stop worrying and love nuclear Daily Reckoning Australia

It may not yet have dawned on Australia, but the rest of the world is waking up to the threat of net zero policies. At our recent editorial meeting in Melbourne, I was shocked to discover just how far behind Australia is on this awakening.

Almost all media coverage in Europe and the US is already highly critical of net zero. Even the politicians have woken up.

In Europe, French President Emmanuel Macron has called for a halt on new green legislation coming out of the EU.

Germany successfully torpedoed the EUs attempt to ban combustion engine cars.

In the UK, some councils are refusing to cooperate with the governments demands to impose net zero policies.

Net zero is so unpopular in the UK that politicians are using it as a punching bag for all sorts of barely related shortcomings. For example, one minister is blaming her inability to carry out Brexit reforms on the constraints imposed by the emissions commitment.

Companies worldwide are also turning their backs on net zero at an increasing pace. Seven insurance companies have quit the Net-Zero Insurance Alliance a part of the powerful group called the Glasgow Financial Alliance for Net Zero which pressures financial industries into adopting net zero policies.

Even the only remaining cheerleaders for net zero journalists are having second thoughts. The Financial Times covered the staggering cost of a green hydrogen economy.

Financial markets cottoned on to this shift first. Green energy stocks plunged in 2022 and clean energy tech companies favourite bank in California went bust in 2023

Just when an energy crisis was supposed to prove renewable energys credentials and capabilities, the world concluded the precise opposite. It turned to coal instead.

While Australia still grapples with the impossible implications of net zero, the rest of the world is already moving on to pondering solutions instead. And, as slowly as humanly possible, theyre reaching the painlessly obvious solution: nuclear power.

In October 2021, the UKs Independent Review of Net Zero report commissioned by the government concluded that nuclear power is a no-regrets option for the UK.

In April 2022, the UK government outlined its plans for nuclear power. These include building eight new reactors plus smaller modular reactors, set to provide 25% of the UKs electricity demand by 2050.

In Japan, utility companies are applying for 27 reactor restarts, with 17 passing safety checks and 10 resuming operations.

In South Koreas March 2022 presidential elections, a pro-nuclear candidate defeated an anti-nuclear incumbent who planned to phase out nuclear power.

The countrys 26 reactors produce about a quarter of its electricity, but the new president wants to increase this to at least a third. Plans include extending the life of existing reactors and building new ones.

Macron committed to building...

05:07

WikiLeaks Founder Julian Assange Facing Extradition After Losing Challenge "IndyWatch Feed Crypto"

Julian Assange, the founder of WikiLeaks, is facing extradition from Britain to the United States after losing a challenge that would prevent that. Assange, who is wanted on 18 charges related to the release of confidential U.S. military records and diplomatic cables, will, however, renew his appeal next week according to a report by Reuters. The British High Court ruled that Assange had no legal grounds to challenge the extradition decision.

Previously, a British judge ruled against Assange's extradition, citing concerns about his mental health and the risk of suicide if held in a maximum security prison. However, the decision was overturned on appeal after the U.S. authorities provided assurances, including the possibility of transferring Assange to Australia to serve any sentence.

WikiLeaks gained prominence in 2010 for releasing classified files and diplomatic cables, marking one of the largest security breaches in U.S. military history. As a journalist, Assanges platform highlighted war crimes and incredible breaches of public trust by the U.S. military. His efforts to bring crimes and actions committed by the government to light have been met with furious retaliation despite the protections journalists should receive, even when reporting on sensitive information. To punish Assange for his work is to set the precedent that journalists who delve too deeply into government affairs will be made an example of.

Assange's case has drawn international attention and sparked debates regarding freedom of the press and the potential implications for whistleblowers. The renewed appeal next week will be a crucial moment in determining Assange's fate as he continues to fight against extradition to the United States.

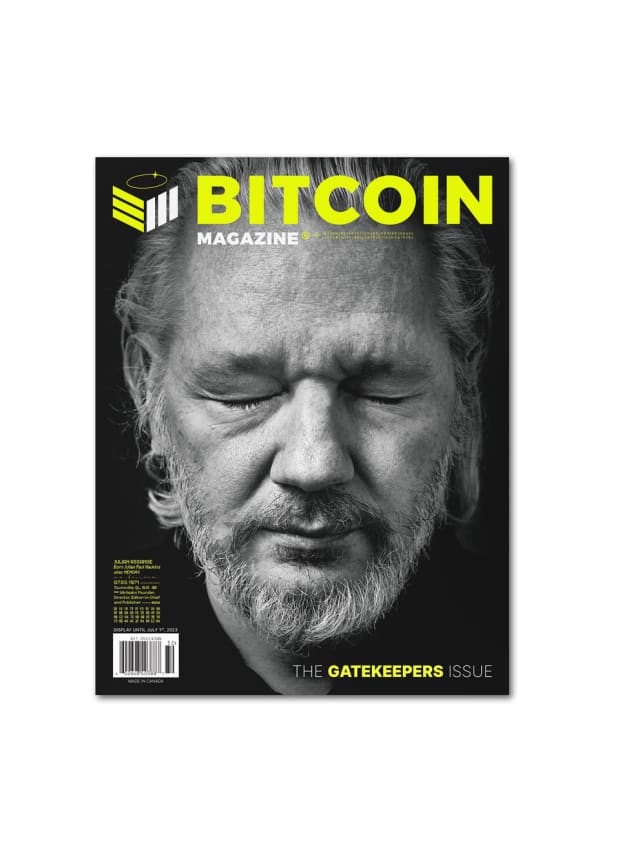

The latest issue of Bitcoin Magazine Print is the Gatekeepers Issue, featuring Assange on the front. We lead the editorial of The Gatekeepers Issue with an open letter to Julian Assange titled Dear Julian, a download page for the cover story explains. In this piece, the author likens Assange's actions to those of ancient Greek Titan, Prometheus. To read the full story, you can input your email to receive a virtual copy of the open letter and to fully appreciate the Gatekeepers Issue, you can sign up for a subscription here.

Thursday, 08 June

22:30

Australia's Commonwealth Bank Will Partially Restrict Payments to Crypto Exchanges "IndyWatch Feed Crypto"

Australian dollars (Squirrel photos/Pixabay)