| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Tuesday, 04 July

23:42

Listings remain low, but... Pete Wargent Daily Blog

23:23

Quick as a flash, nothing happened Pete Wargent Daily Blog

13:40

Race Riots and Culture Wars Daily Reckoning Australia

What was it like?

What?

Parisduring the riots.

Were there riots?

Every country has its railroad tracks. And some people are inevitably on the other side of them. In Paris, poor people tend to live in the suburbs. One of them got killed by police last week. Those of us in the centre of town barely noticed.

Nationwide, the French seem to be having their own George Floyd moment.

Heres CNN:

Chaos, destruction and confrontations have led to curfews in some towns around the capital. Bus and tram services faced disruptions with a nationwide shutdown ordered for 9:00pm on Friday to try to stem another night of violence.

Areas within some of Frances major cities have erupted in violence for several successive nights after a teenager named Nahel Merzouk, reportedly of Algerian descent, was fatally shot by police an incident caught on video.

More than 800 people were arrested the night of 29 June, as outrage continued to intensify. Merzouks death appears to have become a flashpoint for anger about racial inequality in France and claims of police discrimination.

Culture warriors

Meanwhile, racism is a big deal in the US too. There is a whole brigade of culture warriors ready to call it outstamp it outand duke it out. They see racism everywhere.

The Daily Beast: White Professor Disgusts Women Historians Conference:

A conference for female historians this weekend was plunged into turmoil when a prominent white academic speaking at the main event said her professional life would have been easier if she were black.

She was immediately called out for her blatantly racist remarks, and refused to apologise, let alone listen, to the reason why her remarks were horrifyingly wrong

And heres another click-baiting headline from something called BuzzLoving:

White men are a danger to society, says a member of San Franciscos reparations committee.

This past weekend, the US press reeled and railed over the Supreme Courts latest decision on universities race-based admissions programs. In brief, the court recognised that you cant discriminate in favour of one group (blacks, for example) without discriminating against another (Asians, for instance).

This anti-racist decision was immediately attacked asyesracism!

Fox News:

...Jemele Hill accuses Asians of carrying the water for white supremacy for backing affirmative action decision.

Harvard pledged to go forth and sin no moreat least not openly. It said, however, that it would continue to take other circumstances, beyond test scores and academic achievements, into account.

13:40

How Do You Hold onto a Bird in the Hand? Daily Reckoning Australia

One of the best pieces of advice I received early in my financial advisory career came from a seasoned investment professional.

His words still ring in my ears

Vern, whenever you hear this five-word preface you cant go wrong buying, thats the moment when everything can go wrong.

Why?

Because once every man and his dog thinks something is a sure bet, cant fail, one-way trip to assured wealth, it means that all risk has been discounted out of the investment equationand thats when an investment contains its most risk.

The only thing thats guaranteed in this business is there are no guarantees.

There are two components to an investmentincome and capital gain.

Neither is assured.

For example, in April 2020, during the COVID meltdown, APRA Chairman, Wayne Byres, penned a letter to the banks, stating:

APRA expects ADIs [Authorised Deposit-taking Institutions] and insurers to limit discretionary capital distributions in the months ahead, to ensure that they instead use buffers and maintain capacity to continue to lend and underwrite insurance

As reported by IG Capital at the time

In response to APRAs letter; Macquarie analysts today said that the big four banks may be forced to either reduce or suspend their next wave of dividends completely.

Looking at a stressed scenario; Macquarie posits that bank losses could run as high as $2527 billion per bank. In this possible world, the banks ability to pay dividends (without raising equity) materially diminishes, it was noted.

Recent history has taught us that other sources of income are not set in stone either.

In 2010, with the RBA cash rate around 5%, who would ever have thought a decade later, money in the bank would earn next-to-nothing?

Who could have anticipated how work-from-home would upset the commercial property applecart?

With higher vacancy levels, per-square-metre rent rates have

come under pressure.

Landlords have suffered a double whammyfalling rental income and

lower property values.

Nothing is ever absolutely guaranteed

Things happen that can change market dynamics.

And what was once placed in the category of you cant go wrong buying, suddenly shifts to how did we get this so wrong?

Of the two types of investment returns, income is perceived as the bird in the hand, while growth is the two in the bush.

So, how do you increase the odds of holding onto that bird in your hand?

With the guidance of someone who has been there and done that.

This is an unashamed plug for my good mate, Greg Canavan

Ive been in this business for 37 years and have seen a lot of investment professionals....

09:59

The EU risks repeating another vaccine apartheid with new deals with vaccine companies AFTINET

July 4, 2023: Reuters reports that the European Commission has contracted several European vaccine production companies, such as Pfizer, to reserve capacity to make the EU up to 325 million vaccines a year in case of another future global health emergency. The contracts also obligate the companies to be adequately responsive to crises, including by stockpiling supplies where necessary.

The announcement of these contracts has been met with backlash from members of the Peoples Vaccine Alliance advocating for equitable access to medicines who claim they threaten to repeat the vaccine inequity experienced during Covid-19. As of June 2023, only 35% of people in low countries have received a Covid vaccination compared to 73% in high income countries. The World Health Organisation (WHO) dubbed this inequity a vaccine apartheid which led to large-scale, preventable deaths in the global South.

The EUs announcement of its vaccine contracts comes alongside discussions of a Global Pandemic Agreement by the WHO. The agreement aims to avoid a repeat of the "catastrophic failure" of the Covid pandemic and includes a commitment to reserve up to 20% of any tests, vaccines or treatments for low-income countries in a future global health emergency. However, there are concerns that inward-looking measures to protect supply lines, such as the EUs, threaten the Global Pandemic Agreement and undermine initiatives to ensure equitable access to medicine.

Read Reuters reporting on this subject here and a press release by the Peoples Vaccine Alliance here.

04:36

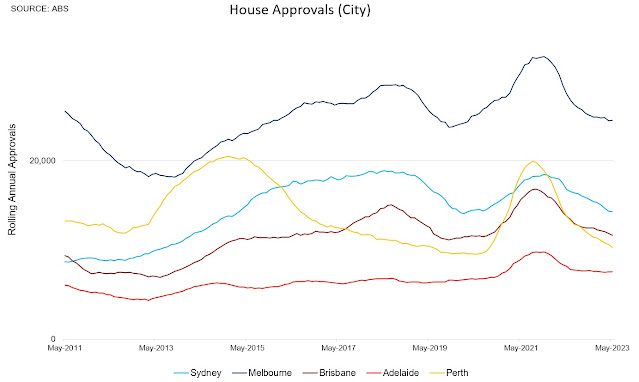

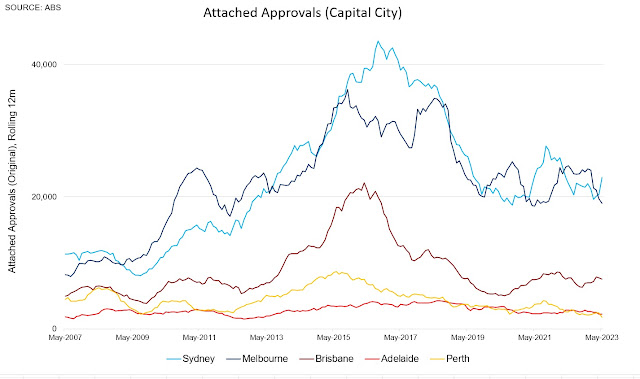

Building pipeline continues to decline Pete Wargent Daily Blog

04:09

Scream if you wanna fall faster... Pete Wargent Daily Blog

03:44

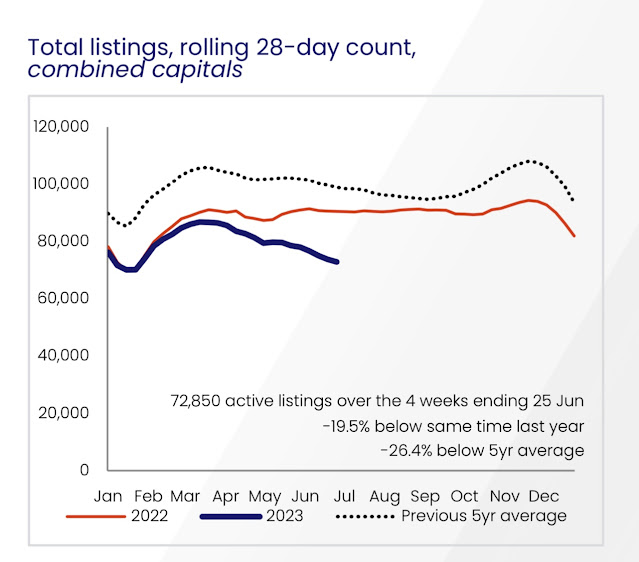

Stock for sale falls further Pete Wargent Daily Blog

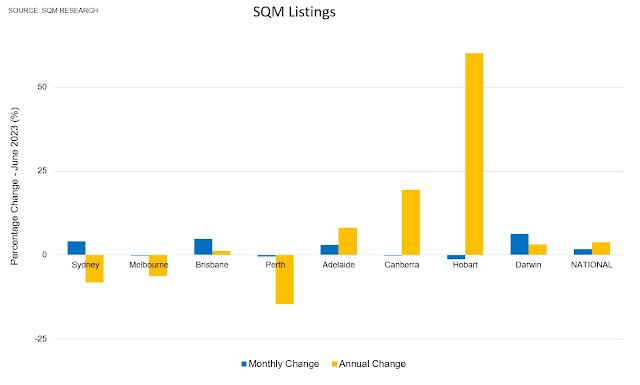

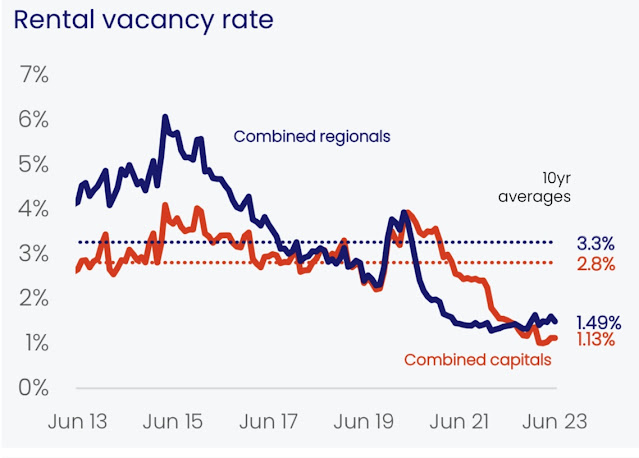

Capital city vacancy rates remained at a record low of 1.1 per cent.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 03 July

17:17

Australian Vintage [ASX:AVG] Shares Jump 10% as It Undertakes Strategic Review Daily Reckoning Australia

Australian Vintage [ASX:AVG], the company behind popular wine brands Tempus Two, McGuigan, and Nepenthe, has announced the initiation of a strategic review to explore options to unlock shareholder value.

Investors were relieved at the news, with the share price jumping by 10% today, trading at 43 cents per share.

The decision comes in light of the challenging business environment faced by AVG, including inflationary impacts, pressure from consumer trends, and tough market dynamics affecting pricing.

The market has reacted to these challenges, with AVGs shares declining by nearly 40 % over the past year. While the company experienced a surge in demand during the pandemic as consumers shifted to at-home consumption, reaching a 13-year high of 89 cents between March 2020 and June 2021 it remains a far cry from the highs witnessed in the early 2000s.

Source: Trading View

Australian Vintage explores alternatives

Australian Vintage announced today the beginning of a strategic review by corporate advisory firm E&P to explore options to unlock shareholder value in a challenging environment.

The decision to undertake the review comes in the wake of a challenging mid-June trading update for Australian Vintage, which highlighted the impact of the cost-of-living pinch on demand for affordable wines among Australian consumers.

The company responded by cancelling its final dividend and announcing a $9 million cost-cutting plan to mitigate ongoing inflationary pressures and the negative effects of excess wine capacity on margins.

Despite these challenges, AVG has managed to increase its market share across all key geographies, particularly in the rapidly growing Zero and Low-alcohol wine markets.

Craig Garvin, the former Australian CEO of Parmalat dairy business, leads Australian Vintage as its CEO...

14:00

Australian Dollar and Bitcoin "IndyWatch Feed Crypto"

1.00 AUD = 0.00002 BTC

0.00010 BTC = 4.65 AUD

Converter

13:20

A large government presence required for energy transition does not mean massive deficits are required William Mitchell Modern Monetary Theory

There appears to be confusion among those interested in Modern Monetary Theory (MMT) as to what the implications for a green transition that will fasttrack the transition to renewable energy will require by way of government. I regularly see statements that government deficits will have to be massive for extended periods because the private (for

12:24

Monday Message Board John Quiggin

Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please.

Im now using Substack as a blogging platform, and for my monthly email newsletter. For the moment, Ill post both at this blog and on Substack. You can also follow me on Mastodon here.

12:07

Honduras risks losing $11 billion in ISDS case after repealing laws created by authoritarian government AFTINET

June 30, 2023: US company Prspera has launched a $11 billion dollars Investor State Dispute Settlement (ISDS) claim against Honduras for repealing a controversial law.

ISDS is a mechanism within some trade agreements which enables foreign (but not local) investors to sue governments for millions and even billions of dollars of compensation if they can argue, among other reasons, that a change in domestic law or policy has reduced the value of their investment.

Honduras law, passed by corrupt officials of the post-coup Honduras government, allowed foreign investors to establish Economic Development and Employment Zones (ZEDE). ZEDEs are essentially private cities outside of the jurisdiction of the government which grant investors the power to create their own security forces, governance systems, regulations and separate courts.

The recently elected democratic government has repealed the ZEDE law to ensure that democratic governance applies to these zones. Despite strong public support for the repeal, and the concern over the threat of ZEDEs to democratic protections, Honduras risks losing nearly two-thirds of its national budget if Prsperas case is successful and will have to spend millions defending the case.

You can read more about this case here, or about the dangers of ISDS in AFTINETs updated briefing here.

11:51

The obsession with surpluses Crispin Hull

The Federal Government has posted the first actual surplus for 15 years as distinct from a projected surplus with celebratory coffee mugs just before covid struck.

The essential lesson is not to get stuck on the mantra of surplus good, deficit bad and that that is the be-all and end-all of budgetary (or fiscal) policy. Governments are not like households. They do not have to keep spending within the bounds of income or go bankrupt.

And besides, as every mortgage holder knows, some debt is a good because it generates wealth in the long term.

The Government should not be congratulated on delivering a surplus (of $19 billion). Rather it should be congratulated on doing fairly well the other important elements of budgetary policy: tweaking according to whether the economy is inflationary, on one hand, or sliding into recession on the other; redistributing wealth in measured ways; promoting good economic activity and discouraging bad activity by applying taxes or tax breaks; and delivering services that people might otherwise not be able to afford.

A surplus right now is good, not because surpluses are good per se, but because the economy is in an inflationary mode which needs braking. It is better that the sledge-hammer of high interest rates does not do that alone.

Similarly, when then Treasurer Josh Frydenbergs black surplus coffee mugs turned red with embarrassment after covid struck he should not have been condemned for running a deficit because deficits are bad per se. Rather, he should have been applauded for tipping money into households when it was needed.

If there had been no covid and Frydenbergs surplus had eventuated, there still would have been good grounds for saying his fiscal policy was deeply flawed. Taking the wrecking ball the government service and vast hand-outs to mates and marginal seats for projects of dubious economic merit are no way to run fiscal policy. It was the equivalent of a household borrowing to finance holidays rather than a house.

From the 1990s, the Coalition successfully convinced much of the broader community that its obsession with surpluses was warranted. However, that obsession disguised a more passionate, but flawed, agenda: that of reducing government spending and thereby...