| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Thursday, 22 June

23:41

Pakistan: Escaping the Sovereign Debt Trap Pacific Money The Diplomat

The key to escape Pakistans sovereign debt trap is hiding in plain sight deleveraging.

18:03

RBA wants to destroy the livelihoods of 140,000 Australian workers a shocking indictment of a failed state William Mitchell Modern Monetary Theory

My early academic work was on the Phillips curve and the precision in estimating the concept of a natural rate of unemployment, or the rate of unemployment where inflation stabilises at some level. This rate is now commonly referred to as the Non-Accelerating-Rate-of-Unemployment (NAIRU) and my contribution was one of the first studies to show

14:56

Repost from 2002: Bush declares war!! Sacrifice Is For Losers John Quiggin

Bush declares war!!

Sacrifice

Is for Losers

(on death duties)

This is the first of what may become a regular series of reposts from 21 years ago.

13:15

Unfree Markets Daily Reckoning Australia

Why should we, the indispensable race, be constrained by nature? Arent we masters of it, not subject to it? After all, if we can set the worlds interest rates and its thermostat, what cant we do?

So many breakthroughs, advances, and improvements; we can scarcely catalogue them, much less keep up with them. Stocks are up. Consumer price inflation is going down. After falling for two years, real wages are stabilising. And the Russians are going to wave a white flag any day now.

And theres Jake Sullivan. After advising Hillary Clinton and Barack Obama, hes now at work for the Biden Team. Every day on the job, he makes the world a better place.

One Giant Step

Let us begin thereand look at a giant step forward for humanity. The Biden Administration has just said goodbye to the free enterprise system that was holding us back for so many years. Now, we will have un-free enterprise; surely that will be an improvement.

Like it or not, you must admit that capitalism is messy. That is its nature. It creates new wealth, but it destroys old wealth, too. You never know exactly which way it is going. But now, Sullivan tells us that he and his fellow elite apparatchiks are going to fix it. They know where they want to go. And theyre going to force US enterprises to take them there. The Wall Street Journal:

laissez-faire is out, industrial policy is in. Markets allocate capital to achieve the highest return to private investors, but as Bidenomics sees it, they dont take account of issues like climate change, fragile supply chains or geopolitical vulnerability. That is why Germany became dangerously dependent on Russian natural gas and China dominates the supply of many critical minerals and pharmaceutical ingredients.

To correct these market failures, Bidenomics aims to direct private capital toward favoured sectors via regulations, subsidies and other interventions. Advocating industrial policywas once considered embarrassing now it should be considered something close to obvious, Sullivan and Jennifer Harris, a colleague in both the Obama and Biden Administrations, wrote in a 2020 essay in Foreign Policy magazine.

Under BidenomicsUS foreign policy champions a range of economic interests, from workers rights to climate policy and tax compliance. Consumers and competition are not primary concerns.

Bidenomics accepts the value of markets but sees market failure all around.

Who decides?

Let us simplify and clarify. People create wealth by providing goods and services to each other. Neither acts of Congress, agency regulations, or presidential proclamations add a penny to our prosperity.

Then, after the people have created wealth, they decide what to do with it. Or someone else decides for them...

13:15

How to Reduce Bill Shock This Winter Daily Reckoning Australia

Unless youre living in northern Australia, youve been experiencing wintery conditions well before June. In fact, May this year was the coldest month for over half a decade.

No doubt most households turned up the heater or put an extra log or three into their fireplaces to keep warm.

Many likely experienced bill shock when their utility bills arrived.

Speaking for myself, our usage hasnt changed much year-on-year, but Im paying 3050% more for my electricity and gas.

As of 1 July, its going to get just that much tougher.

I received an email from my electricity supplier explaining its increasing the price of my usage by another 50%. The daily supply charge will increase by 20%. Similarly, my gas supplier increased the price of my usage in March by around 40%.

Youve probably heard about this already from family and friends.

Its a kick in the guts for many households already struggling to make ends meet. We lived through the ravages of the Wuhan virus outbreak thanks to measures by the government and public health bureaucrats which crippled our economy.

The economic broken window fallacy at work

Many Australians went to the polls last May to oust the Coalition in the hope that the ALP would follow through with their promises to cut electricity bills.

The ALP did have this as a major promise in their election campaign.

However, last October the ALP quietly removed that page from their website.

Do you want to guess why they did that?

To be fair, the ALP did roll out a rebate on electricity bills to provide relief for eligible Australians (pensioners, ex-veterans and family carers). These households and small businesses could see a $175650 relief on their bills.

Dont forget the sharp increase in our utility bills is partly due to the government trying to quickly phase out fossil fuels.

Were seeking to reduce our reliance on the most dependable and cheap fuel source (coal) to transition into something that has yet to pass the test of powering large cities (solar and wind).

Its the good old economic fallacy of a broken window!

Dont forget that a significant proportion of Australians embraced this last May. They elected more than 10 climate change advocates into parliament (the Teal party)!

We made our beds, so now we lie in them.

A not-so-obscure solution w...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 21 June

17:33

The New Global Financing Pact equals the old failed global financial arrangements William Mitchell Modern Monetary Theory

Its Wednesday and I cover a few topics usually in less depth than usual and provide a musical entree. From tomorrow (June 22 to 23), the so-called world leaders are meeting in Paris for the Summit for a New Global Financing Pact which is being hosted by the French president. The aim, apparently,

14:21

This blog first announced itself to the world 21 years ago, on 21 June 2002. Since then, Ive said a lot of things that seem worth repeating, as well as some that havent aged quite so well. To celebrate the age of majority, Im going to start recycling posts, one day at a time. See what you think

07:38

How Last Weeks High-profile Resignation Will Impact the AIIB Pacific Money The Diplomat

Despite the bad press that it generated, Canadian Bob Pickard's resignation from the Beijing-based development bank is unlikely to have a lasting impact.

07:29

Who Pays and Who Profits From High Energy Prices in Thailand? Pacific Money The Diplomat

Many governments are facing the question of whether to absorb rising energy prices, or put the burden on the shoulders of consumers.

05:18

This is how to value property like a pro Pete Wargent Daily Blog

Australian Property Podcast

I joined Amy Lunardi to discuss how to value properties like a pro.

Tune in here (or click on the image below):

You can watch the video

Tuesday, 20 June

23:13

Australian Payment Provider Cuscal Imposes New Restrictions on Crypto; Industry Body Criticizes Move "IndyWatch Feed Crypto"

Sydney Opera House in Australia (Stanbalik/Pixabay)

22:22

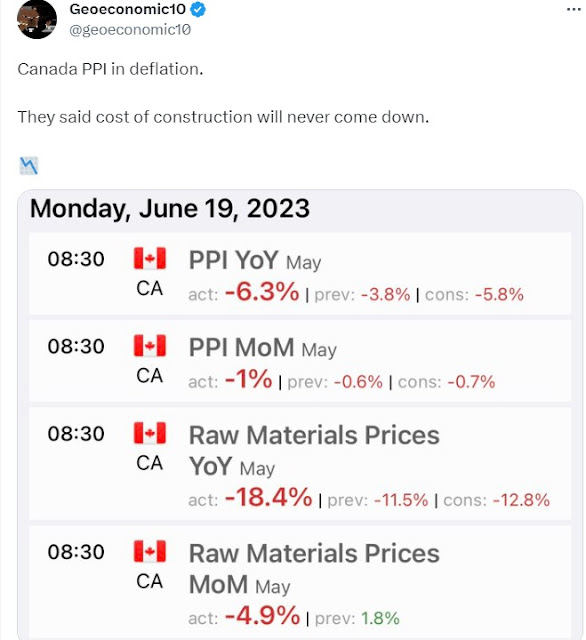

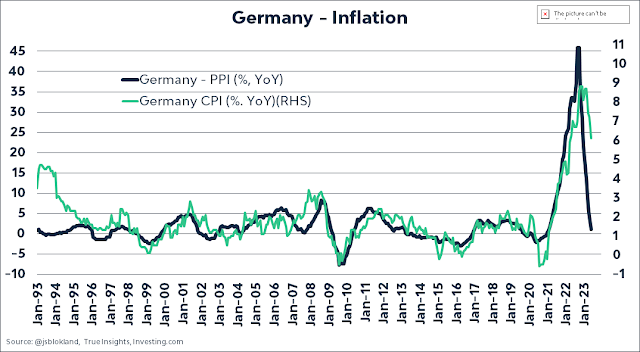

Disinflation ahead, folks... Pete Wargent Daily Blog

20:52

Australian Data Center Startup Arkon Expands to U.S. With $26M in Fresh Funding "IndyWatch Feed Crypto"

The data center purchase is likely to be the first of several. (Shutterstock)

17:41

Residential prices playing whack-a-mole Pete Wargent Daily Blog

ausbiz TV: property trends

I joined Danielle Ecuyer on ausbiz TV to discuss record population growth here (or click on the image below):

15:15

31% of young Aussies hold crypto despite being risk averse ASX survey "IndyWatch Feed Crypto"

While young Australians are more interested in crypto, its the 25- to 49-year-olds who own the most.

13:45

Deadwood, Deadends, and Deadheads Daily Reckoning Australia

Whoathat was a close call. It took us nearly 60 years of disappointment, observation, and regret to get it. We didnt want to lose it.

You dont develop cynicism overnight. It takes business deals gone badpolitical promises that we never meant to be keptinnovations and inventions that didnt work outpublic policies that were idiotic when they began, and disastrous when they ended.

In todays world, where would you be without cynicism? Doing five years in the can for visiting the Capitol building without a permit? Joining the Ukrainian army to protect our democracy? Buying Nvidia and trusting that the Fed really does know what it is doing?

We cant even write those words without chuckling to ourselves. It was only two years ago that the Fed forecast inflation for 2023 at 0.1% now they say it will be 5.6%. They were only off by 5,500%!

Stronger, richer, freer?

Last week, US Government debt passed US$32 trillion. And it is growing fast up by US$10 trillion over the last four yearsand now increasing at US$2.1 trillion per year.

And what do you think? Did a single penny of that debt make the US stronger, richer, and freer? How young do you have to be to believe it?

As the debt rises, so do interest rates. Year over year, the Feds interest payments are up nearly 50%. Next year, more tax money will be needed to support the debt than to support the Pentagon.

The private sector is also paying higher interest rates. Companies that took on billions of debt at 3% interest now have to refinance at 7%. And they cant print money.

From Wolf Richter:

companies that only made it this far thanks to Easy Money are now getting hung out to dry.

Bankruptcy filings will whittle down the corporate debt overhang. Many companies will emerge from bankruptcy with less debt, and theyll be nimbler and more able to thrive. Others will be sold off in bits and pieces, making room for appropriately managed companies not encumbered by these issues.

There is a cleansing aspect to this part of the credit cycle that needs to be allowed to do its job to get rid of the excesses and the deadwood at the expense of investors. This cleansing process that has now just started is long overdue.

Mass VC extinction event

And heres Garrett Baldwin at Postcards from the Florida Republic:

Venture Capital has imploded over the last 18 months. Last week, the Wall Street Journal released a distressing analysis. Theyve found many startups are now unable to secure the funding they need. To say VC has been suffering is an understatement. Tom Loverro, a general partner at VC shop IVP, has said The Mass Extinction Event for startups is underway. Venture capital losses ov...

13:45

A Rich Life is Measured by More Than Money Daily Reckoning Australia

Its 3:42am and todays Daily Reckoning Australia finds me in a reflective mood.

My elderly fathers health is failing.

One fall too many has forced him to surrender his highly prized independence.

We knew this day of reckoning was comingbut its still sad to watch.

A tour of the assisted care facilities provided me with a stark reminder of what constitutes a rich life.

When a financial publication usually mentions the term rich, it tends to be associated with money or a vein of ore.

Not this time.

Dont get me wrong, money is important especially when it comes to paying the not-so-insignificant Refundable Accommodation Deposit (RAD). However, when the final tally on your life is done, true net worth is measured by other factors.

Money cant buy love

In 1964, the year when the last of my parents five children was born, The Beatles hit single Cant Buy Me Love was released.

In Paul McCartneys own words, his motivation for the song was

Cant Buy Me Love is my attempt to write a bluesy mode. The idea behind it was that all these material possessions are all very well but they wont buy me what I really want.

Growing up in a working-class family, material possessions were few and far between. Money was needed for the basicsshelter, transportation, food, clothing, and education. Precious little was left for material indulgences.

Society has changed quite a bit since then.

Credit-funded consumerism has literally consumed the developed and a good chunk of the developing world.

The quip, we buy things we dont need, with money we dont have, to impress people we dont like originally referred to Hollywood. These days, it extends well beyond the zip code of Beverly Hills.

And this increasing obsession with look at me on social media suggests the penny has not yet dropped on true love extending beyond self.

Of the limited number of possessions Dad can take with him, the most prized are his photos of family and friends. These are his permanent reminders of a rich lifeone that money alone cannot buy.

When it all gets distilled down, material goods become immaterial and its not how much you love yourself, but how much you are loved by others.

In the final tally, love and respect are what matters most.

Money cant buy happiness

Long before The Beatles were singing Tell me that you want the kind of things that money just cant buy, Roman philosopher Seneca (4 BC to 65 AD) wrote a letter to his mother.

The titleOf Consolation: To Helvia

Heres an extract

Consider in the first place how many more poor people there are than rich, and yet you will not find that they are sadder or...

13:31

Australias crypto laws risk being outpaced by emerging markets: Think tank "IndyWatch Feed Crypto"

Bermuda and Nigeria are moving faster on crypto than Australia, and the land Down Under will soon need to be up to speed, says Loretta Joseph.

10:31

AFTINET updated briefing paper calls for the urgent review and removal of ISDS in existing trade agreements AFTINET

June 20, 2023 : AFTINET has produced an updated briefing paper on Investor-State Dispute Settlement (ISDS) with the latest case studies.

Investor-State Dispute Settlement (ISDS) is a mechanism within some trade agreements which enables foreign (but not local) investors to sue governments for millions and even billions of dollars of compensation if they can argue that a change in domestic law or policy has reduced the value of their investment, and/or that they were not consulted fairly about the change, and/or that it did not meet their expectations of the regulatory environment at the time of their investment.

ISDS is a flawed system which gives additional legal rights to international investors which already have enormous market power. ISDS cases have been used to claim compensation for legitimate public interest laws and policies on health, environment, indigenous land rights, minimum wages and government action to reduce carbon emissions. This has a freezing effect on essential regulation and undermines the democratic right of governments to regulate in the public interest. Even if governments win ISDS cases, they cost tens of millions to defend.

ISDS flawed processes include: use of ad hoc tribunals, a lack of transparency; lengthy proceedings; high legal and arbitration costs and inconsistent decisions caused by the lack of precedents and appeals. Arbitrators are not independent judges, but instead remain practising advocates with potential or actual conflicts of interest.

Clive Palmer's claim to be a Singaporean investor in order to use ISDS in the Australia-New Zealand ASEAN FTA to sue the Australian government is just the latest example of international investors manipulation of ISDS in trade and investment agreements. The US Philip Morris tobacco company in 2012 also moved assets to Hong Kong and used ISDS in an Australia-Hong Kong investment agreement to sue Australia over our plain packaging laws. Australias large number of previous agreements with ISDS have also enabled international mining companies to use Australian subsidiaries in forum shopping exercises.

ISDS also enables excessively high awards based on dubious and inconsistent calculations of expected future profits, which can reduce significantly government funds for essential services, as occurred with the US $5.8 billion award against Pakistan. Third-party funding for cases as speculative investments which receive a percentage of the award encourages excessive claims, which are more about making money than obtaining justice.

Governments are responding to global movements a...