| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|

Thursday, 10 August

23:39

The Special Investment Facilitation Councils Role in Pakistans Economic Resurgence Pacific Money The Diplomat

The SFIC has to strike a balance between including military decision-makers to raise investor confidence and upholding democratic governance.

17:08

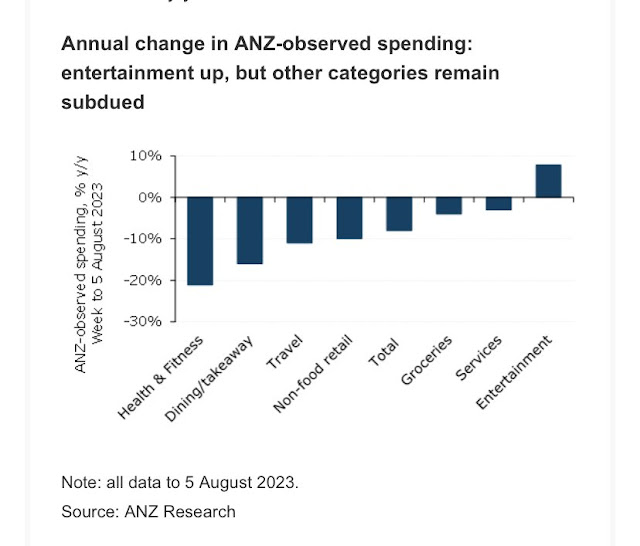

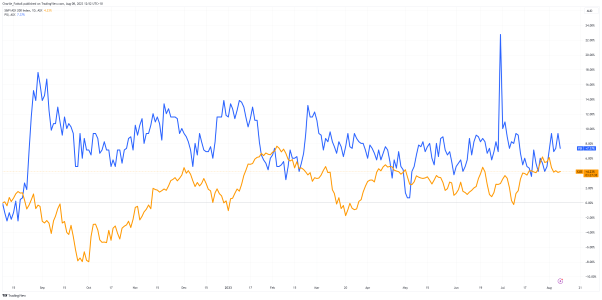

Spending sinks like a stone Pete Wargent Daily Blog

16:13

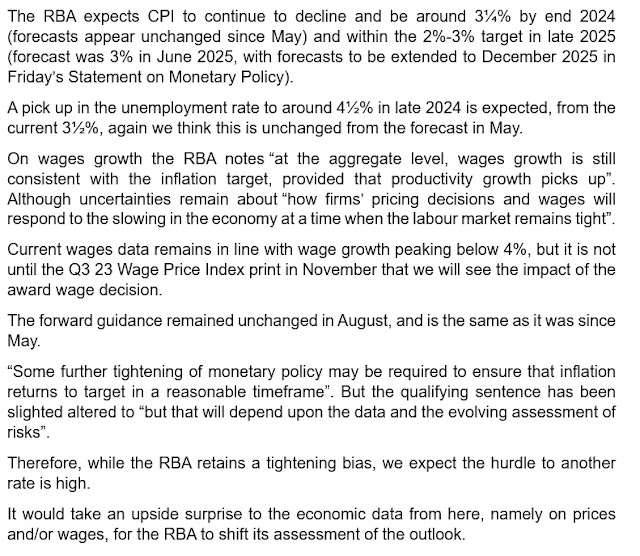

Boral [ASX:BLD] Shares Up 8.1% after Beating Profit Expectations Daily Reckoning Australia

Australias largest building and construction materials supplier Boral [ASX:BLD] has returned to its former glory with significant gains across most metrics in a challenging economic climate.

Boral also told shareholders it will continue raising the price of cement, gravel, and asphalt in the new financial year as soaring interest rates push down the construction of new homes.

Shares of the company were up by 8.12%, trading at $4.72 per share this afternoon, as the results understandably enthused investors.

Boral has seen its share price rise by 63.28% in the past 12 months, outperforming the sector by almost 50% this year.

Source: TradingView

Borals FY23 results

Boral beat most expectations and guidance this year with a strong earnings report today.

The companys net revenue rose 17% to $3.5 billion in the year to 30 June, while earnings jumped 38% to $454.4 million. Operating cash flow lifted 65.5% to $358.7 million.

However, Borals statutory net profit after tax came in at $148.1 million for the 2023 financial year, down from $150 million in the previous year. This also included a post-tax income of $977.6 million from the sale of its US business, Eco Material Technologies.

In other disappointing news for shareholders, the company will also not pay dividends this year.

Boral CEO Vik Bansal said he expects cost pressures to linger for the next 1218 months, which the company will pass on to its customers.

However, he signalled that the increases wouldnt be as sharp as last financial year.

There will be price increases because cost will increase.

Im not saying the price is going to remain steady. All Im saying is the rate of increase will slow down.

Bansal said he was bullish about starting the new financial year and boasted abou...

12:00

Letter from The Cape Podcast Episode 13 William Mitchell Modern Monetary Theory

Episode 13 of my Podcast Letter from The Cape is now available. In this episode, we consider the concept of productivity and discover that the mainstream bias towards a narrow interpretation where a productive worker is only one that generates profits for a private capitalist prevents us from fully understanding

11:54

Revealed Under Oath: The Facts and Lies of Vaccine Safety and Efficacy Daily Reckoning Australia

Ive just arrived in Melbourne from the Southern Highlands on an overnight train, my first time travelling long distance this way. On several occasions, Ive driven up and down the Hume Highway enjoying the rolling hills, pastures with cattle, lamb and horses, and taking stops in several towns along the way.

You might ask why I didnt hop on a planelike the late North Korean dictator, Kim Jong-Il, whose fear of flying due to security concerns meant he only travelled in his bulletproof train?

No, Ive flown on planes before. I last flew in May 2022 to Melbourne but experienced both a delay and a cancellation. I couldve arrived home at the same time had I hopped behind the wheel!

Thanks to the vaccine mandates, the airline industry has never been the same again. Several pilots and ground staff were dismissed for refusing to comply, causing a significant staff shortage.

I recognise that things are starting to improve with Jetstar recently appealing to the public, giving them a second chance now that delays and cancellation rates are falling. But until these mandates lift, expect domestic flights to continue experiencing further disruptions.

So Ill stick with driving or taking the train when I travel to Melbourne.

The myth of vaccine efficacy exposed

My article today isnt about my travels. Its about digging deeper into vaccine mandates and their impact on our society.

The world was conditioned in the last few years to believe that vaccine mandates would be the most effective way against the Wuhan virus, reducing transmissions, hospitalisations and deaths.

Since these mandates, the number of cases and deaths around the world didnt fall. The data from the Australian Bureau of Statistics showed that it rose. Furthermore, word spread that some fell ill, experienced serious side effects, or even died after taking these drugs. Some of you mightve been affected or knew relatives or friends who were.

These mandates divided society as some trusted it was done in our best interest while others believed something nefarious was at hand. However, the plot turned with the release of Matt Taibbis Twitter Files and, more recently, the Facebook Files revealing the collusion between governments, public health agencies, vaccine manufacturers and the media to quash dissenting views. My...

11:53

Bidenomics to the Rescue Daily Reckoning Australia

The current economy is in terrific shape especially compared to what most economists expected. Every day, confidence in a soft-landing increases, and even the Fed seems convinced, despite an unprecedented rapid rise in interest rates.

current GDP growth of 2.4%, well ahead of expectations. Inflation is at 3%, down from 10% just last year. Unemployment is at a 54-year low, at 3.7%, despite predictions that unemployment would substantially increase. Wage growth has been particularly strong at around 4%, and most commodity prices are down some 50%, with some down considerably more.

Saved the economy? New ages of prosperity?

Why doesnt he get credit? Why not give Harry Truman credit for the urban renewal program in Nagasaki after 1945? Why not give Chief Sitting Bull credit for reducing payroll costs in the seventh Cavalry?

Plague of the black debt

Wage growth is not particularly strong at all. Because there is none. Adjust the 4% growth to inflation, using the core measure, and you get real wage growth at MINUS 0.8%. And how about that 2.4% GDP growth? Strip out the Feds transfer payments and boondoggles, and growth flattens out. Because what Biden did was nothing more than continue the bonehead policies of his predecessor: stimmies to the voters, subsidies to crony industries, gifts to Zelensky et aland enough weapons to keep the killing machine in gear.

This is fiscal inflation. It helps delay a correctionfor a while. But it gives us a Banana Republic deficit at 8% of GDPnational debt accumulating at US$5 billion per dayrising bond yieldsand an upcoming headache that is going to be one for the record books. All this debt will eventually have to be rolled over at higher ratesand inflated away.

Thirty years ago, we published a small booklet, written by our friend, James Dale Davidson, entitled The Plague of the Black Debt: How to Survive the Coming Depression. We warned that US debt was getting out of control.

Back in 1993, US federal debt was just over US$4 trillion. There was still time to bring it down. And for a while, in the late 90s, it actually did go down as the Clinton Administration ran a few serendipitous surpluses. But then, along came George W Bush with his War on Terrorand the debt pile grew quickly.

Empire of debt

In 2005, with Addison Wiggin, we wrote a book, Empire of Debt. Our theme was that the attempt to bring the whole world under the US thumb funded by borrowing money would lead to big trouble. The accumulated debt would end up making us weaker, not stronger. By then, US debt had doubled to US$8 trillion.

And now, empire spending including money for soldiers, spooks, the World Bank and embassies, et al has risen to US$1.5 trillion PER YEAR. Total US Governm...

07:23

Free 15-minute diagnosis call Pete Wargent Daily Blog

Free diagnosis call

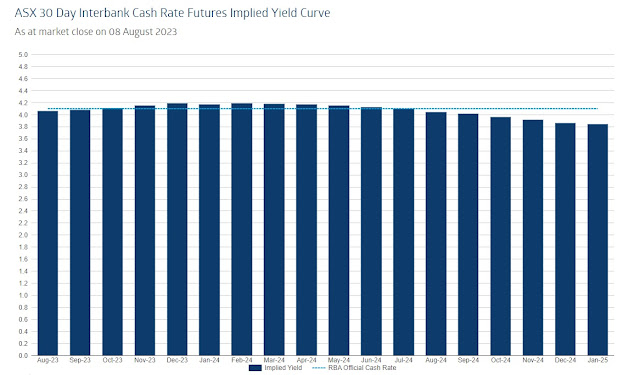

Financial markets believe we're about to hit an inflection point for this cycle, with interest rates set to peak imminently, before potentially falling again over the next couple of years.

It's certainly a confusing time with many fixed rate mortgages resetting to higher loan rates, and some borrowers struggling with repayments - yet investment lending is also now on the rise again as the market senses the peak of the interest rate cycle ahead.

As such, I'm getting bombarded with questions about selling some (or all) of a property portfolio, but also when and where it might be time to invest in property again.

Rather than try to deal with every random enquiry over email, I'll run ten free 15-minute diagnosis calls over the next week or so on a first come, first served basis.

Email me at pete@gonextevelwealth.com.au with 'Diagnosis call' in the email title and we can book in a Zoom call next week.

Ta!

... |

07:08

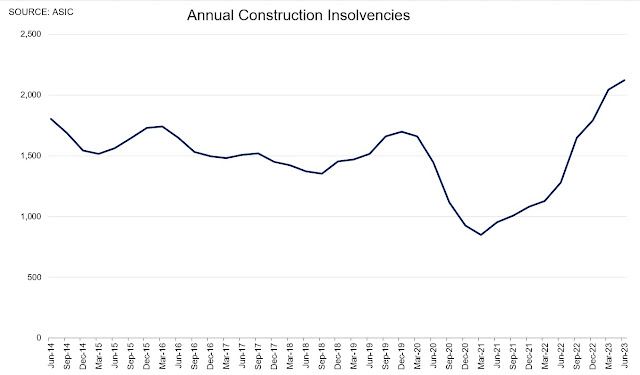

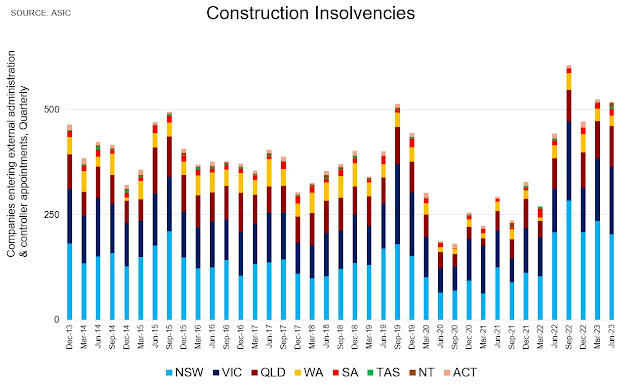

Construction costs up 40pc since pandemic onset Pete Wargent Daily Blog

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 09 August

17:24

The conflicting role played by education in social mobility and class reinforcement William Mitchell Modern Monetary Theory

Sometimes everything comes together in unintended ways. That has happened to me this week. I am moving office tomorrow, and I am also moving home, and if that wasnt enough, I received a call from a union I help out with advice who wanted some urgent work done. The major employer had presented a sort

06:10

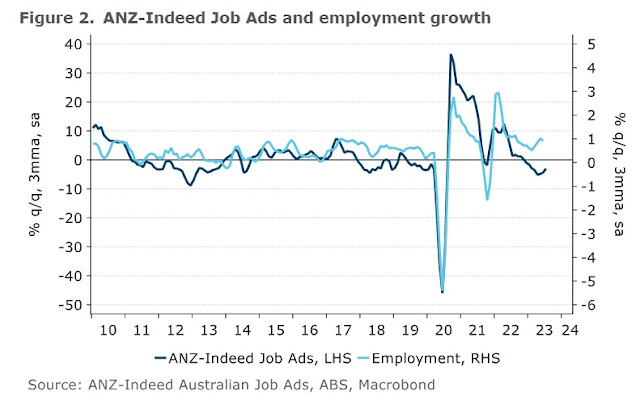

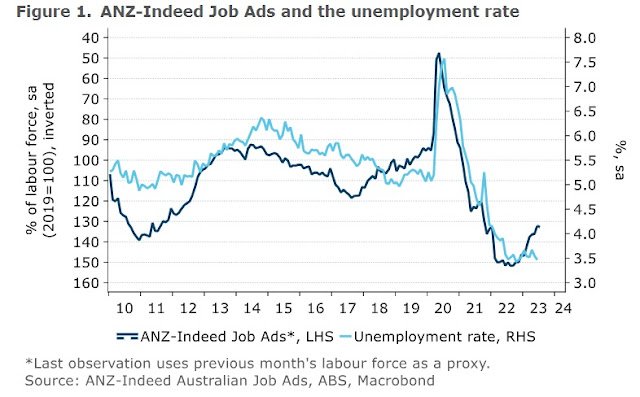

Labour market softening... Pete Wargent Daily Blog

02:39

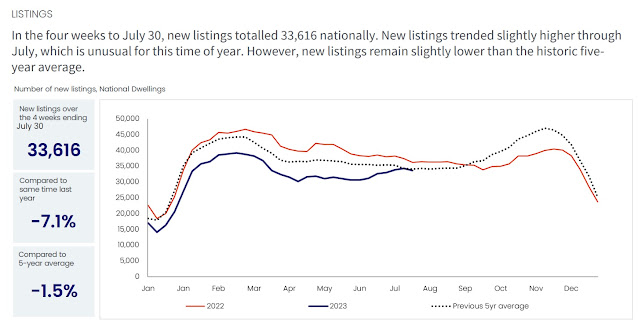

Winter listings continue to be absorbed Pete Wargent Daily Blog

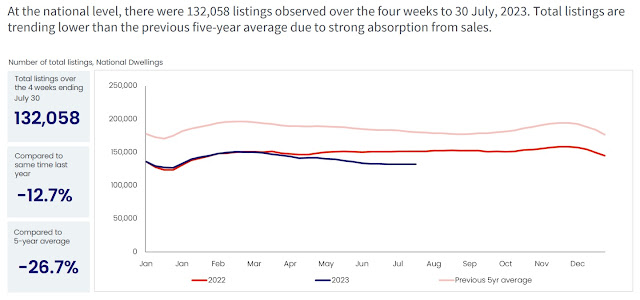

Stock absorption

Unusually for this time of year, listings increased in July according to CoreLogic.

That said, over the past week the surge did not continue.

SQM listings

Separately,...

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Tuesday, 08 August

23:21

Chinas July Exports Tumble by Double Digits, Adding to Pressure to Shore up Flagging Economy Pacific Money The Diplomat

The export contraction was the biggest since the start of the COVID-19 pandemic in 2020.

16:21

PSC Insurance [ASX:PSI] Makes Bid for Ensurance [ASX:ENA] Daily Reckoning Australia

Multinational PSC Insurance Group [ASX:PSI] has announced that it has entered into a binding scheme implementation deed to acquire all of the shares of Ensurance [ASX:ENA] for $25.2 million.

Shares of PSC were down by 1.22% today while Ensurance saw its shares explode in morning trading, with shares up 33.75%, trading at 26.8 cents per share.

PSC Insurance specialises in turnaround acquisitions within the insurance sector, with a long track record of reviving businesses that operate within Australia, the UK, Hong Kong, and NZ.

It has had a slow and steady year of growth with shares of PSC up by 8.04% in the past 12 months.

The only notable shift from its usual trading occurred right before the end of the financial year, which saw a massive jump.

This had some market watchers accusing funds of attempting to take advantage of the relatively low liquidity in PSC to boost their period-end performance.

Source: TradingView

PSC offers $25.2 million for Ensurance

PSC Insurance has issued a bid for Ensurance today. To fund the acquisition, PSC will issue 5 million shares to ENA shareholders and pay any difference in value to the $25.2 million remaining in cash.

The purchase price represents an implied valuation of Ensurance of $18 million plus $7 million in assets, largely represented in cash held by the company.

The valuation represents a 40% premium to ENAs closing price on Monday of 20 cents a share.

Ensurance operates an Australian-based underwriting business specialising in construction and terrorism & sabotage underwriting across Australia and the UK.

PSC said the acquisition will add a high-growth operation and new product suite to PSCs Australian Specialty businesses led by PSCs Adam Burgess.

PSC expects an annualise...

15:37

What Indias Rice Export Ban Means for Southeast Asia Pacific Money The Diplomat

The impacts are likely to reflect the differing role that rice plays in each country's political economy.

12:23

The Comic Opera Daily Reckoning Australia

It rechristened its territories

As the Banana Republics,

And over the sleeping dead,

Over the restless heroes

Who brought about the greatness,

The liberty and the flags,

It established a comic opera

-Pablo Neruda

Angels gasped. And the dead generations rolled their dry eyes in disbelief.

Americans thought they could turn Nicaragua, Honduras, Haiti and Venezuela into dynamic democracies just like their own country. They sent in troopsPeace Corps volunteersdo-goodersconsultantsentrepreneursinvestorsmoney. They scarcely noticed as their own homeland went bananas.

Two important things happened last weekeach signalling another milestone passed. While we were at an opera in Austria, an ex-president was indictedand Fitch downgraded the most important asset in the entire world US Government debt.

No one is above the law, said the mainstream press with the mock piety of those who fashion the laws to suit themselves.

Respectfully broke

This is the first time an ex-president has been charged with a criminal offence. Our guess is it wont be the last. Becausethats what they do in Banana Republics. And over in the GOP, lawyers are already at work building a cage in which to lock up Joe Biden for conspiring with his son to peddle influence in Ukraine.

As to the downgrade of US Treasury bondsit doesnt matter was the near-universal refrain. The economy is strong. You cant look at it as though it were a private business or a household.

You cant? Oh yes you can.

The US is going broke, just like a private business. But in the real economy, companies cant print money to cover their excess expenses and hide their shame. Nor do they have the biggest spade in the world the worlds reserve currency to dig a hole for themselves. When a private business or household takes on too much debt, lenders pull back. On Main Street, businesses and households still go broke in a common, respectable way.

Not so the US Government. Its bankruptcy will be one for the record books. It will pay its debts with cheap, printing press money.

And there, front and centre, is El Jefe, Joe Bidenwith his Bidenomics. Does anyone know what it is? Does Joe have any idea what he is talking about? The poor man cant carry a tunelet alone a coherent economic policy. The signature element of Bidenomics, as near as we can determine, is simply Chiquita Finance. You enjoy the warm weather as long as possible spend, spend, spendborrow, borrowborrow. And then, on a cold day, you pour gasoline over your head and set yourself on fire. And heres the latest from MarketWise: The US debt will rise by more than US$5 billion every single day for the next decade:

As the investment world still comes to grips with the Fitch Ratings dec...

12:22

The Land of Rising Yields Part Two Daily Reckoning Australia

Surprise, surprise, surpriseFitch Ratings downgraded its US debt rating from AAA to AA+.

Is the US at risk of default?

No.

If the US Government needs money to meet its obligations, itll be printed. But, as we now know, too much money printing can lead to inflation.

A future filled with inflationary waves is a very real prospectlike it was in the 1970s. And thats not good news for holders of debt issued at lower rates or share investors.

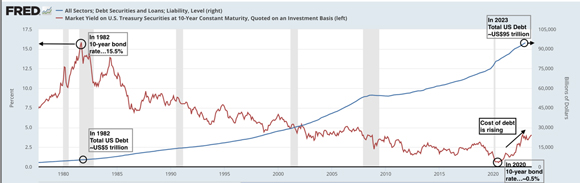

Over 40 years ago, it took a US 10-year bond rate of 15.5% to slay the inflationary dragon.

In the early 1980s, total US debt (private, corporate and public) was around US$5 trillion.

As rates (the cost of debt) trended down, the volume of debt trended up.

|

|

|

Source: FRED |

In 2020, the US 10-year bond rate went to a low of just0.5%thats 15% lower than it was in 1982.

Obviously, when the cost of borrowing is SO cheap, resisting the temptation to gear-up is almost impossible. Since 2020, the US debt has gone from US$75 trillion to US$95 trillion.

The math is staggeringover the past four decades, the US debt burden has increased by US$90 trillion.

However, the days of cheap money appear to be over. The cost of debt is rising, which explains why Fitch has concerns over a blowout in future Federal budgets.

How will successive administrations be able to afford the interest bill WITHOUT printing?

The answer isthey cant.

The prospect of persistent global inflationary pressures is unnerving bond markets. Pressures are building.

This is why the Bank of Japan (BoJ) has started taking steps to be less controlling with its yield curve c...

05:25

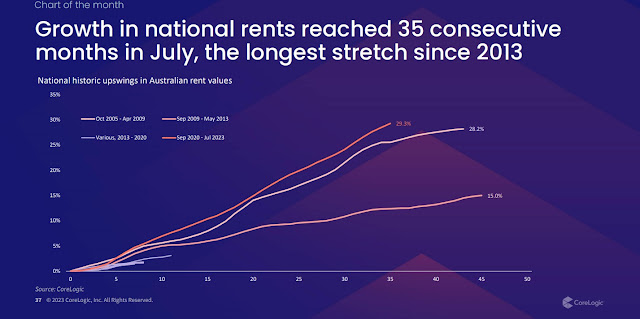

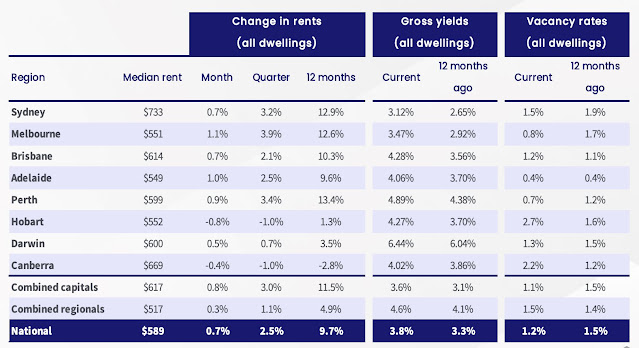

Melbourne has a rentals problem Pete Wargent Daily Blog

01:35

The time value of money Pete Wargent Daily Blog

Time value of money

Check it out here (or click on the image below):

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Monday, 07 August

20:28

A Voice plan & why we feel financially drained Crispin Hull

Memo Prime Minister Anthony Albanese: Now you have committed to the referendum this year, you must to everything you can to get it across the line.

The No campaign has used every dirty trick of lies, exaggeration and fear campaigns. The Yes campaign does not have to join them in deceit, but it has to get a bit clever.

A big leg up for Yes would come if the Federal voting age were reduced to 16.

The Constitution gives the Parliament the power to set the voting age. Do it. The Greens, the Teals and independents would see it sail through the Parliament. Give the Electoral Commission extra resources to get the youngsters on the roll before the vote.

After all, the young people (who are more likely to vote Yes) are inheriting the mess; shouldnt they get a say in fixing it up? Older people who are more likely to vote No have less of a stake in the future and so a counter-weight is warranted.

Be astute. Be bold. Dont shy away from having a truth and treaty process later. Be honest and up front. It is better to go down fighting an honest fight, than winning, like the No case, fighting a dishonest one.

Besides, putting the reduced voting age through the Parliament would get the Federal Opposition into an enormous tizz. The ensuing frothing at the mouth and sense of outrage would distract them from dreaming up even more absurdities to support the No case.

In June, Green and Independent MPs gave their support to the Make it 16 campaign launch at Parliament House. The Coalition and Labor stayed away. Labor should now change its mind.

Most 16-to-18-year-olds are much more savvy on political and societal issues than many elderly. Indeed, there is a sounder case for removing the vote from elderly people who fail some basic tests (a bit like drivers licences) than for denying it to younger people.

At 16, Australians can and/or must marry, pay tax, work full-time, learn to drive, give consent for medical procedures, serve in the military, pay fines, and be charged as an adult. Why not vote? And make it compulsory like everyone else.

Meanwhile, get stuck into the fundamental inconsistency in Opposition Leader Peter Duttons position. He says he wants constitutional recognition for Indigenous people, but does not say how that can be achieved with overall support of the Indigenous people. So far, five years of extensive consultation has come up with only the Voice, nothing else.

The sort of hello, we whitefellas recognise you but were not doing anything more was rejected in the 1999 referendum.

Demand Dutton puts up his model for recognition and see what Indigenous people say about it. Without their agreement, it is not recognition.

Dutton says he wants a voice for indigenous people, but says it can only be legislated. So, what precisely is the difference between legislating now under the existing race power in the Constitution and legislating under a new Voice power other than the obvious one that legislating under the race power is historically tainted?

Both versions of a voice can be enacted, changed, and calibrated by the Parliament, so why not have the one Indigenous people want?

And that is the nub of it. The Coalitions No campaign rests on the position of no Indigenous input other than that of a tiny minority of self-aggrandisers or delusional demanders of something more now.

O O O O O O

We are headed for personal recession, according to last weeks Reserve Bank quarterly review. That is, income after allowing for inflation and population growth will fall. We are going backwards. And our productivity is...

11:03

US labour market steady as she goes William Mitchell Modern Monetary Theory

Last Friday (August 4, 2023), the US Bureau of Labor Statistics (BLS) released their latest labour market data Employment Situation Summary July 2023 indicated a rather steady as she goes outcome. A slightly weaker employment outlook compared to the beginning of 2023 but overall a very stable situation. There is no sign

10:50

Multi-billion ISDS case for Netherlands climate action ruled inadmissible AFTINET

7 August, 2023: German utility company, RWEs, 1.4 billion euros Investor State Dispute (ISDS) case against the Netherlands climate laws was ruled as inadmissible under EU law.

The Netherlands introduced climate action laws in 2019 which would ban the use of electricity generation from 2030. RWE, which opened a new coal plant in 2015, said they were set to lose 2 billion euros and filed an ISDS case claiming damages to their investment using provisions in the Energy Chater Treaty (ECT).

ISDS is a mechanism within some agreements, including the ECT, which enables foreign (but not local) investors to sue governments for millions and even billions of dollars of compensation if they can argue, among other reasons, that a change in domestic law or policy has reduced the value of their investment

Multinational company Uniper also claimed the Netherlands phase out of coal negatively affected their investments under ISDS provisions, but Uniper withdrew the case after it was taken over by the German government in late 2022. However, total arbitration costs for the Netherlands, paid by taxpayers, have already amounted to 5.4 million euros.

Eight EU countries have now withdrawn from the ECT, citing the risks of being sued for carrying out climate policy. The ECT has generated the highest number of ISDS cases of any treaty (157). Denmark and New Zealand have both stated that potential ISDS cases have dampened their climate ambitions.

06:06

Can the Voice be Saved? John Quiggin

Im pretty despairing about the prospects for the Voice referendum. The current strategy is failing badly. There is an alternative that I believe might work, but I have pitched it in a few places and had no interest. So Im putting it for the record and on the off-chance that someone might pick it up.

On present indications, the Voice referendum is doomed to defeat. Polls show the Voice failing to win either a majority of votes or a majority of states. Past experience suggests that support for referendum proposals invariably declines over time, and that most fail. In the last fifty years, the only successes have been marginal tweaks to such items as a retirement age for High Court justices and the procedure for replacing senators. But two earlier successes offer some hope. The 1946 referendum on Social Service and the 1928 referendum on the Loans Council succeeded because they provided a firm constitutional basis for vital policies that were already in operation. The other important , though primarily symbolic, success was the 1967 referendum recognising Indigenous Australians

So, the ideal approach to the Voice would have been to legislate it first, and constitutionally entrench it later. But theres still a chance to do the next best thing. The Parliament, in consultation with First Nations and community in general, could legislate a model that would come into effect if, and only if, the referendum was passed. The government has insisted that the design of the Voice should be left to the Parliament of the Day, but as far as initial design is concerned this is a distinction without a difference next years Parliament will be the same as this years.

06:04

Monday Message Board John Quiggin

Post comments on any topic. Civil discussion and no coarse language please. Side discussions and idees fixes to the sandpits, please.

Im now using Substack as a blogging platform, and for my monthly email newsletter. For the moment, Ill post both at this blog and on Substack. You can also follow me on Mastodon here.

02:36

2-Sense: Could easing inflation lead to an interest peak? Pete Wargent Daily Blog

2-Sense

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Saturday, 05 August

10:30

The Green Fraud: How Climate Alarmists Are Scamming You (Part Four) Daily Reckoning Australia

Surging sea levels will inundate the coasts. This is false. Sea levels have risen at the same pace for 100 years, unaffected by climate change or human activity. The rate of increase is about seven inches per 100 years. Thats barely enough to get your feet wet in 2121 if it persists, which it may not.

Hurricanes are becoming more powerful and more frequent. This is false. The 2014 US National Climate Assessment said, There has been no significant trend in the global number of tropical cyclones nor has there been any trend identified in the number of US land-falling hurricanes. There is evidence that property damage from hurricanes is increasing. Does this mean hurricanes are getting stronger? Not at all. It just means that rich owners with subsidised insurance are building mansions on sandbars where they dont belong. Thats not climate change. Its stupidity.

Tornadoes are more powerful and more frequent. This is false. National Oceanic and Atmospheric Administration (NOAA) records from 19542014 show the number of tornadoes in the US of EF1 or greater (EF is the Enhanced Fujita Scale of tornado strength) is fairly consistent at about 400, with occasional spikes in 1973, 1982, 2008, and 2011. The number of tornadoes in the US of EF3 or greater has been steady at around 40, with spikes in 1957, 1965, 1973, and 2011. No correlation has been shown between tornado strength and CO2 emissions.

Snowstorms are becoming more frequent with greater accumulation of snow. This is false. Snowstorms are highly localised so, of course, measurements vary, with some locations getting more snow, some less. A chart of annual snowfall in Washington, DC, from 18892018 shows the annual snowfall in inches has been trending downward for the entire 130-year period. If climate change has any impact at all, it is causing less snow. And there is no correlation between climate change and an increase in CO2 emissions.

Wildfires are destroying larger areas more frequently than ever before. This is false. Satellite data from NASA reveals that the global area burned annually by fires from 19982015 has declined by about 25%.

Similar data exists for ice sheets, droughts, floods, and other weather-related outcomes. In short, none of the extreme outcomes that the climate alarmists shout about are true. And there is no conclusive evidence that any extreme weather, when it does occur, is caused by human activity or CO2 emissions.

It is true that CO2 emissions are increasing. Its also true that scientists have detected a slight trend toward global warming.

There is no clear evidence that human-caused CO2 emissions are the principal source...

10:30

Farewell Net Zero, We Hardly Knew You Daily Reckoning Australia

A few months ago, I joined an editorial ideas meeting in Melbourne and net zero unexpectedly popped up at the top of the agenda. What struck me was how far behind Australia is. Not in achieving net zero, but in discovering its thorny implications.

My work in Europe with Nigel Farage and keeping up with daily German news had highlighted just how controversial saving the planet had already become over there. Australia just hadnt gone through the same reckoningyet.

Since then, net zeros challenges have become part of Australias news cycle too. The public has discovered what Europes power bill payers learned about a year earlier.

The cost of achieving net zero has been underestimated by an order of magnitude thatd make a government public transport feasibility study look conservative.

The feasibility of a net zero energy system has been overestimated by an amount thatd get Elon Musk arrested for false advertising.

There simply arent enough mineable resources needed to build a net-zero energy system anyway.

Living standards under net zero would be worse than the Second World War rationing.

Green energy is not cheaper once you factor in energy storage and transmission costs.

The cost of updating the power grid alone is prohibitive.

And so on and so forththe revelations have been flowing.

Today, I want to update you on your future once more. Because, once again, Europe is leading the way on net zero. Or should I say out of net zero?

In the UK, which The Telegraph declared, is a world leader in net zero fantasies and delusions, the worm has already turned. This could be the beginning of the end of net zero, it says. Why? Every net zero policy has been a flop and you are paying the price, reads another headline.

Even the politicians have woken up, in the only way they know how. The UK Government recently faced a series of by-elections. It lost two seats but managed to hold onto one where a peculiar local issue dominated the debate.

The London Mayor wants to expand the Ultra-Low Emissions Zone into that electorate, which wouldve cost local drivers a lot of money. The Government opposed the change, and so it held onto the seat.

This seems to have caused some sort of political awakening for the Government in the UK. It has realised that neutering net zero is its only hope of getting re-elected. The slogan, Dont elect Labour, theyll only do more of what weve been up to isnt going to fly.

The biggest question in UK politics now is just how far the Government will go in undermining its own net zero policy. And the answer appears to be quite far, with hundreds of new oil and gas licenses to be issued in the North Sea for a start. Most of those would be worse than worthless under net zero commitments

Its not just those in government who have woken up. Former Brexit negotiator Lord Frost...

03:56

Emerging Markets in Asia Are Rushing to Adopt Central Bank Digital Currencies Pacific Money The Diplomat

For countries like China, India, and Indonesia, CBDCs offer tempting solutions to several issues including the dominance of the U.S. dollar.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Friday, 04 August

23:10

Will Hong Kong Become a Crypto Hub? Pacific Money The Diplomat

The Hong Kong government has made their desire to turn Hong Kong into a crypto hub well-known, with tacit support from Beijing.

10:41

UK and EU FTAs seeking to restrict Indias lifeline production of affordable medicine to Global South AFTINET

4 August, 2023: India is currently negotiating Trade Agreements (FTAs) with the UK and EU, among other countries, which include demands for stricter intellectual property rules, threatening Indias production of generic medicines and role as pharmacy of the world.

India is one of the largest scale producers of affordable generic medicines and accounts for a fifth of global supply. It is also the largest supplier of generic medicines to Africa in 2018, and is essential source of medicines for the Global South.

MSF and other health organisations have said their ability to treat some of the most vulnerable communities is reliant on generic medicines such as these. Indias production of generic HIV and AIDS medicines drove down the cost of treatment during the HIV and AIDS pandemic, and saved countless lives.

However, India can now produce these lifesaving medicines at affordable prices because it has strictly interpreted the 1995 Trade-Related Aspects of Intellectual Property Rights (TRIPS) Agreement which gives 20-year monopolies to charge high prices for new medicines which enables it to produce cheaper generic medicines as soon as patents have expired.

The UK, EU and US, pressured by their giant pharmaceutical companies, have used bilateral and regional trade agreements to push for TRIPS-Plusrules which delay the production of cheaper generic medicines beyond 20 years. India has so far resisted these pressures.

The leaked intellectual property chapter of the India-UK FTA shows that the UK has tabled TRIPS -plus provisions that threaten to tighten the screws on Indias production, supply and export of affordable generic medicines beyond even the TRIPS agreement obligations.

The UK and...

08:27

Temporary population respite as Aussie tourist gallivant around Europe Pete Wargent Daily Blog

00:30

Making the Most of the EUs China De-risking Policy Pacific Money The Diplomat

EU exports to China and the ensuing vulnerabilities are even more complicated than they appear.

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Thursday, 03 August

13:55

No change in monetary easing from Bank of Japan until wages growth increases William Mitchell Modern Monetary Theory

The media and the phalanx of mainstream economists from banks etc, the latter of which have a vested interest in interest rates rising in Japan for various reasons, are constantly predicting that the Bank of Japan will relent to the market pressure and reverse its current monetary policy stance and fall in line with the

12:21

The Sun Also Sets Daily Reckoning Australia

Responsiblestatecraft.org:

The left claims that racism and other intolerances in the ranks have caused Americans to turn against the military; the right says woke politics are at the root of increasing alienation. Perhaps the culture indeed is responsible for the 25% shortfall in recruitment but beware of partisan narratives that appear to speak for everyone and explain trends so neatly. Never is anything that simple.

Nope. Not that simple. The right supposedly thinks the military is too woke. The left supposedly thinks it is not woke enough. But what if the real reason Americans are losing faith in the Pentagon is neither? What if they are losing faith in Congressin the White Houseboth political partiesin the Supreme Courtand in the whole shebang?

They, the elite

What if The People are catching on? What if they are realising that the military works for the eliteand that the elite deciders work for themselves, not for The People?

Why do we have US$32 trillion of federal debt? Why do the Feds continue to add more?

Bloomberg reports:

The Treasury Department increased its net borrowing estimate for the July through September quarter to US$1 trillion, well up from the US$733 billion amount it had predicted in early May.

US$1 trillion dollars in just three months. And every penny of it will be paid one way or another by The People. Wars, boondoggles, claptrap programs why are there so many of them?

And yes, the superficial reasons for these things are obvious: they pay off for the deciders.

Bloomberg again: Lockheed Is Reaping US$2.3 Billion So Far Restocking the Pentagon:

Pushing to restock depleted US weapons stockpiles, the Pentagon has already committed almost US$2.3 billion of a potential US$6 billion to Lockheed Martin Corp, the top maker of munitions that the US has provided Ukraine in its fight against Russias invasion, according to new Defence Department data.

Unequal men

But in this sea of woe, woke, and weirdthere are deeper currents. Megapolitics is the term coined by our friends, James Davidson and Lord Rees Mogg, to describe them. Largely invisible, rarely understood, and impossible to contradict, they sweep us along like plastic bottles on a flood tide.

All men are created equal is an idea. The 375 Zulu warriors killed at Rorkes Drift was a fact. And behind that fact was another one: the handful of English soldiers who killed them had rifles. The Zulus had spears. For hundreds of years, the power relationship was so unequal that Europeans were able to colonise much of the worldwhile neither Africans, Asians, nor the Indians of North or South America colonised any p...

12:21

Unmasking Fauci and The ScienceTM Daily Reckoning Australia

Many people arent aware that theres a difference between science and The ScienceTM.

This isnt a conspiracy theory. Theres a logical reasoning underpinning it.

And your health and well-being rely heavily on being able to discern the two.

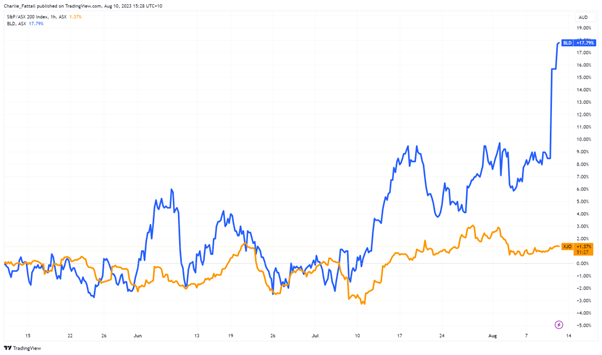

The truth is that many things we think are scientifically proven are nothing further from the truth. Rather, they are cleverly designed marketing strategies by governments, large corporations and other institutions to assure their intended audience of the benefits of a certain product.

Some of you mightve been around when doctors endorsed smoking as a healthy habit. They even used consensus data such as this poster to make it appear as if its scientifically proven:

|

|

|

Source: Country Gentlemen, 1946 |

In hindsight, we realise the absurdity and the deception behind it. We dont know who these many doctors are, their credentials, or the grounds on which they gave their opinion. Tobacco companies engaged in unethical means to extract the desired outcome. This included distributing cigarette packs to doctors, asking loaded questions, and changing the narrative on the health

Nowadays, we know theres empirical data to show that smoking can cause different forms of cancer as well as damage to the respiratory system. And tobacco companies paid dearly for it when the truth came out. However, theyd made billions and the compensation was likely a slap on the wrist especially g...

03:49

Easing cycle to begin in 2024 (buffers still too high) Pete Wargent Daily Blog

Stress tests too high

Go Back:30 Days | 7 Days | 2 Days | 1 Day

Wednesday, 02 August

19:49

Property Q&A...all your questions answered! Pete Wargent Daily Blog

17:19

Ratings downgrade on US government debt is as ridiculous as it is meaningless William Mitchell Modern Monetary Theory

Its Wednesday and there are a few topics that warrant some comment. But at the top of the topics were headlines this morning shouting out that the US treasury bonds had been downgraded by one of those self-serving credit rating agencies, as if it was an event worthy of some import. The journalists obviously do

| IndyWatch Australian Economic News Feed Archiver | |

|

Go Back:30 Days | 7 Days | 2 Days | 1 Day |

|

IndyWatch Australian Economic News Feed was generated at Australian News IndyWatch. |

|